The more cars are sold, the higher the income, but when can the loss stop?

On the evening of April 2, NIO disclosed its delivery performance for March and the first quarter. The next day, NIO’s Hong Kong stock price rose by 2.14%, but it fell by 7.63% and 5.6% respectively in the following two trading days. Its US stock price fell for three consecutive trading days.

Coincidentally, when NIO disclosed its 2022 earnings and February sales in early March, the first feedback from NIO’s dual-stock was equally optimistic. So how did NIO perform in March and the first quarter? What about its performance in 2022?

The first quarter of the first quarter met expectations, and the sales volume was "among the best"

Data show that in March, NIO deliveries were 10,400, an increase of 3.94% year-on-year, down 14.63% month-on-month; among them, 3203 high-end smart electric SUVs were delivered, and 7175 high-end smart electric cars were delivered. In the first quarter of this year, NIO deliveries were 31,000, an increase of 20.46% year-on-year.

In terms of industry level, whether in March or the first quarter, among several new power car companies, NIO’s performance can be regarded as "among the best". In addition to being led by Li Auto, Nezha, Xiaopeng, Zero Run, etc. were all left behind by NIO. It is worth mentioning that the ideal sales volume in March was twice that of NIO.

However, once upon a time, the throne of the new power delivering the championship has been firmly occupied by NIO. Whether the future NIO can regain the championship throne is uncertain, but it seems unlikely this year.

This can be seen from the annual sales target and current sales performance of NIO and Ideal 2023: the former’s goal this year is 250,000 vehicles, the first quarter sales of 31,000 vehicles, to complete the annual sales target of 12.4%; while the latter’s goal is between 250,000 – 300,000 vehicles, the first quarter sales of 52,600 vehicles, to complete the annual sales target of 21.04% -17.53%.

From the current data performance, NIO has suffered a lot.

It is worth noting that although NIO has achieved its sales target for the first quarter of this year, it can only be said to be a near miss.

According to NIO’s previous expectations in the 2022 annual performance report, its delivery volume in the first quarter of this year will be between 31,000 – 33,000 vehicles, an increase of about 20.3% -28.1% year-on-year. It can be said that NIO completed the delivery task in the first quarter.

"The image is from the NIO announcement."

In addition, NIO expects revenue guidance for the first quarter of this year to be 10.62 billion – 11.54 billion yuan, an increase of about 10.2% -16.5% year-on-year. But there is no clear guidance for earnings expectations.

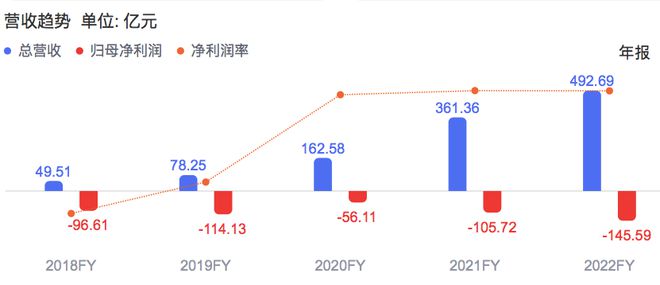

However, it may be reasonable. After all, NIO, which saw a 33.97% year-on-year increase in sales in 2022, has not achieved profitability despite a significant increase in revenue. Instead, its losses have further expanded.

Sales revenue has skyrocketed, so why are there more losses?

According to the financial report disclosed by NIO, in 2022, NIO sales reached 122,500 vehicles, an increase of 33.97% year-on-year; revenue reached 49.269 billion yuan, an increase of 36.34% year-on-year.

From the perspective of sales and revenue data, both have reached new highs, and NIO’s performance last year seems to be good. However, in the face of both sales and revenue growth exceeding 30%, NIO’s overall profitability not only did not rise, but its losses further expanded.

The financial report shows that NIO’s net profit attributable to the parent last year was a loss of 14.559 billion yuan, 10.572 billion yuan from the loss in 2021, an increase of 37.71% year-on-year.

At the same time, NIO’s bicycle net profit also changed from a loss of 115,600 yuan in 2021 to a loss of 118,900 yuan in 2022. That is, in 2022, NIO lost nearly 120,000 yuan for every car sold.

In addition, NIO’s net loss reached 14.437 billion yuan last year, compared with the net loss of 4.017 billion yuan in 2021, and the loss expanded by 2.6 times.

The question is, sales are rising and revenue is increasing, so why are you losing more and more money? Where is the money being spent?

From the financial report, the two largest expenses of NIO are sales costs and research and development expenses, which alone cost nearly 55 billion yuan, directly exceeding revenue.

Specifically, in 2022, NIO’s sales cost reached 44.125 billion yuan, an increase of 50.5% year-on-year. This is not unrelated to last year’s "expensive electricity" and the large-scale laying of replacement stations, charging stations, charging piles, etc., which has become a direct cause of dragging down NIO’s profitability.

In 2022, affected by the skyrocketing price of lithium carbonate, battery costs skyrocketed simultaneously, which also caused the cost of new energy vehicles to rise sharply, which in turn led to a sharp drop in automotive gross profit margins. According to the financial report, NIO gross profit margin has dropped from 20.1% in 2021 to 13.7% in 2022.

"The image is from the NIO announcement."

NIO’s R & D expenses last year were as high as 10.836 billion yuan, up 136% year-on-year from 4.592 billion yuan in 2021, accounting for nearly 22% of revenue. Whether it is from the investment amount or the proportion of revenue, it can be regarded as a big deal in the automotive industry, which shows NIO’s emphasis on R & D.

You know, Li Auto and XPeng Motors invested 6.78 billion and 5.215 billion yuan in research and development last year, respectively, while accounting for 14.97% and 19.42% of revenue respectively.

To sum up, NIO’s sales revenue has increased, but it still loses money "for a reason", but for a for-profit company, this is obviously not "reasonable", but exposes its lack of cost control and profitability.

So, is the NIO that loses money really bad? Please continue to pay attention to "Automotive K Line", and we will look for answers in the next article of the NIO 2022 financial analysis article.

The text is original by [Car K Line], some pictures are sourced from the Internet, and the copyright belongs to the original author. The article of this number may not be reproduced without authorization, and violators will be investigated. At the same time, the content of the article does not constitute investment advice to anyone. The stock market is risky, and investment needs to be cautious.

关于作者