Every reporter: Shu Dongni Every editor: Chen Junjie

"In 2025, China cosmetics will reach a trillion scale and is expected to become the world’s largest consumer market." In 2021, some data institutions gave predictions. However, according to the market research results of Intemin, the growth rate of cosmetics market has obviously slowed down this year. What changes have the epidemic brought to the cosmetics industry? A few years ago, the tide of domestic products was rough, but now it’s gone?

Around the above two issues, from August 23rd to 24th, at the 15th China Cosmetics Conference in Pinguan 2022, six entrepreneurs from the upstream and downstream of the cosmetics industry, from brands, channels and raw material producers, accepted an exclusive interview with the reporter of national business daily, including Li Jianfei, chairman and CEO of Vitality Group, Liu Qianfei, founder of Zhuben, Wu Tao, CEO of Yanli Cosmetics (China) Co., Ltd., and Shi Mingliang, founder of global growth system.

They told reporters that under the influence of the epidemic, the cosmetics industry as a whole bid farewell to high growth, but the sub-sectors such as efficacy skin care are gaining momentum; In the past, star enterprises entered a painful period of transformation, but it does not mean that the tide of domestic products has subsided, but the tide of capital has subsided. Farewell to the flow dividend, the cosmetics industry has entered the research and development era from the marketing era.

Image source: Photo Network -500692755

With the development of national economy, many industries, including cosmetics industry, are welcoming the wave of substitution of domestic products.

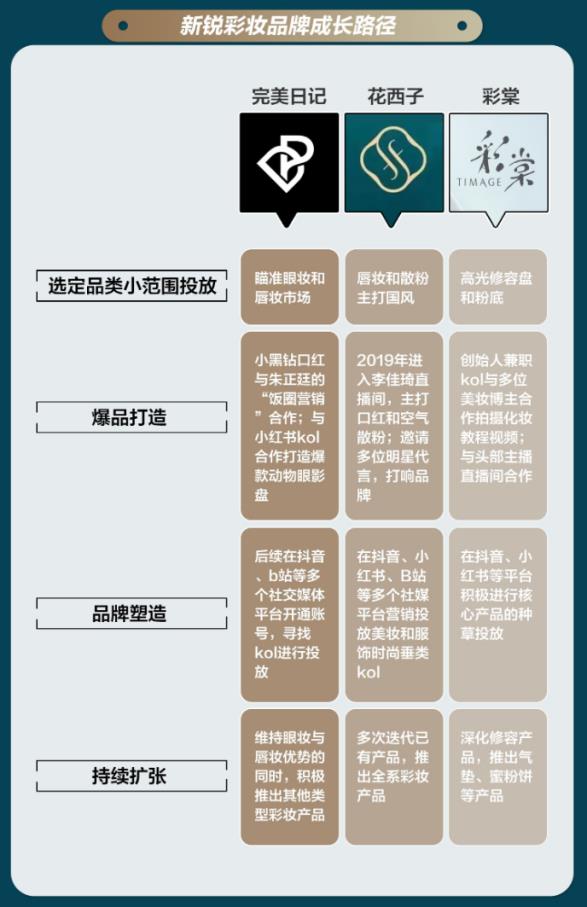

In 2020, Perfect Diary (that is, Yixian e-commerce YSG, with a share price of 1.32 US dollars and a market value of 788 million US dollars) landed in the capital market, becoming the first share of domestic beauty products, bringing the light of domestic products to the cosmetics industry, accelerating the influx of capital, and spreading financing news one after another in the industry, which also opened the biggest stage of domestic products.

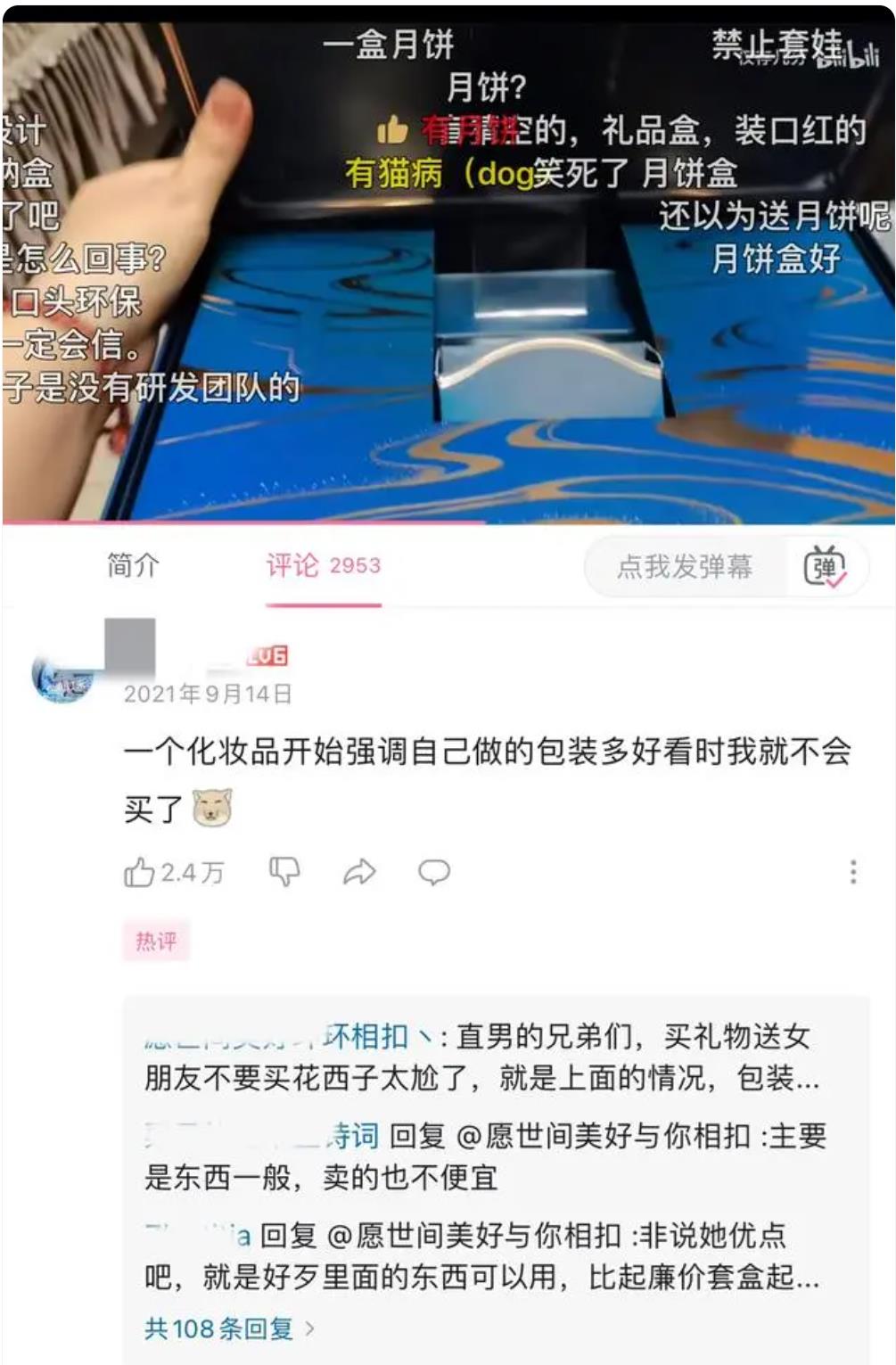

However, the performance of the perfect diary after listing fell short of expectations. In less than a year and a half, it received a warning of delisting, and the impact of the epidemic was superimposed. The voice of the domestic product tide in the market was not as good as before. So, did the tide fall?

In response to this problem, the six interviewees all said that the tide of domestic products has not subsided. They believe that the fundamental driving force of the tide is the change of consumer demand, and young consumers have more confidence in national brands. Although affected by the epidemic, consumers are still enthusiastic about domestic products.

"Capital is an amplifier. The so-called ebb and flow is the ebb of capital investment in cosmetics industry." Liu Qianfei, the founder of the book, said.

In Liu Qianfei’s view, the perfect diary was successfully listed, and the capital had a good exit case in the secondary market, which led to a lot of "hot money" flooding into the primary market. Capital began to ripen cosmetics enterprises, resulting in a large number of capital grabbing projects, overvaluation of projects, rapid growth of new domestic brands and so on, which is also the time when the wave of domestic products is the biggest.

Now that capital has returned to rationality, investors of the whole consumer brand are worried about uncertainty, project selection is more critical, the threshold is higher, decision-making is more prudent, and the calmness of the secondary market is passed on to the primary market. Liu Qianfei believes that capital magnifies fear and anxiety.

Shi Mingliang, founder of the global growth system, said that in the past few years, domestic beauty products have experienced multiple dividend periods of price leveling, channel and online development of low-cost traffic, and domestic brands have ushered in rapid development. Now these dividends have subsided, and star enterprises in the past have also entered a transition period. But this does not mean that the tide of domestic products is fading.

Shi Mingliang pointed out that the fundamental driving force of the domestic goods boom stems from the national confidence of the younger generation. "Looking back to Japan, South Korea and the United States, in the past 100 years, a large number of national brands have risen, and China is also experiencing great development. Many local brands have risen. Any country will surely usher in the rise of the national tide in the process of the same economic development."

Li Jianfei, chairman and CEO of Vitality Group, also expressed the same view. He believed that it was unrealistic to accomplish what others had done in 20 or 30 years in just two or three years by relying on traffic, new channels and new demands. To a certain extent, the epidemic has accelerated the retreat of bad enterprises and brought the market back to rationality, which is more conducive to the development of the industry.

Li Jianfei also mentioned that the tide of domestic products has attracted more people’s attention to this industry, and resources and talents have flooded into the industry, which has also brought new development momentum and opportunities to the industry.

At present, the national pride of consumers in China is increasing. According to an Intel survey, 48% of beauty consumers aged 18-49 support the local economy. They are not only full of confidence and pride in local products/raw materials, but also hope to express their support for the local economy through their purchase behavior.

In the observation of Jin Yaoting, a senior analyst at Intemin, in recent years, consumers’ enthusiasm for buying domestic brands has surpassed that of Japanese and Korean brands.

Located as a direct chain brand of imported cosmetics, Yanli Cosmetics (China) Co., Ltd. has cooperated with more than 300 brands so far. Wu Tao, CEO of Yanli Cosmetics () Co., Ltd., said that Yanli started as an international brand at first, because there are no particularly high-quality brands in China. With the development of the industry, high-quality domestic brands have been rising in recent years. Since 2020, Yanli has also begun to introduce domestic brands.

"It’s not particularly much. We will inspect many aspects such as unit price, technology research and development and brand concept." Wu Tao said that although the current operation is still dominated by international brands, domestic products are still in fashion.

Image source: Photo Network -500553887

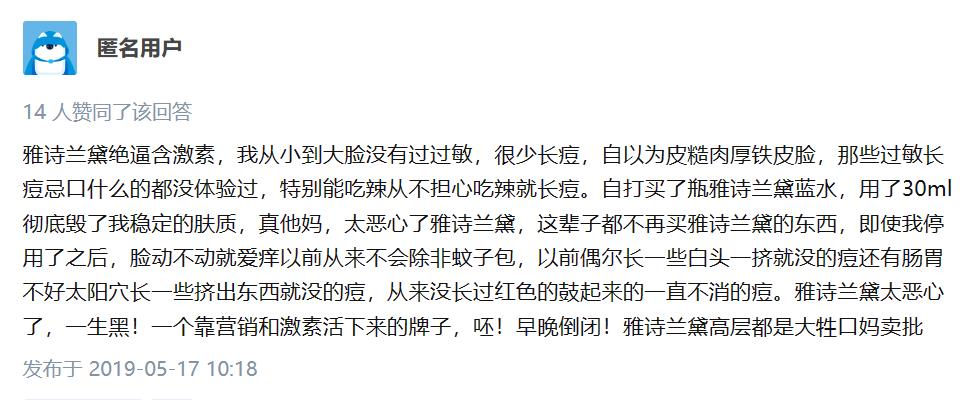

However, it is undeniable that the domestic tide of cosmetics encountered an epidemic, and both of them also reacted. Six entrepreneurs all talked about the three-year epidemic has brought many changes to the cosmetics industry. To sum up, there are three points. The first is that the cosmetics industry has entered the era of research and development from the marketing era, and the past traffic play method is not feasible.

Li Hewei, founder and chairman of Weibo Haitai Biological Group, said that one change is the intensified competition in channel marketing. Whether it is from live broadcast, short video or planting grass in the whole channel, the input-output ratio (ROI) is getting lower and lower.

Wu Tao said that under the influence of the epidemic, offline traffic decreased, prompting cosmetics companies to look for new traffic online, and channels and brands were online, which also made online traffic more and more expensive, and enterprises that smashed traffic as brands and channels were accelerated to be eliminated.

The epidemic has also accelerated the cosmetics industry into the era of intensive cultivation. "Before 2022, the playing styles of all brands tend to be the same. In the live broadcast era of online celebrity’s economy, there will be differentiation in every subdivision of the track. Some will intensively cultivate ecology, some will focus on efficacy skin care, and some will be medical beauty skin care. The future category and traffic play will be extremely differentiated." Liu Qianfei said.

"Before the epidemic, enterprises paid attention to traffic-driven, and now everyone pays more and more attention to the operation of internal strength. Before the meeting, everyone focused on live broadcast, traffic, private domain and operation, and this year it focused entirely on the profit level." Shi Mingliang mentioned that in the cosmetics industry, the cost before the epidemic has been pre-positioned, and the post-epidemic era has become a cost post-positioning.

"Cost pre-positioning means that a lot of costs are invested before the results are obtained, such as traffic delivery, high pit fees and endorsements, which means that the representatives are very confident in themselves. After the epidemic, especially since the beginning of this year, it is basically a post-cost thinking. Everyone may not even be willing to pay a penny before seeing the sales, and the advertising revenue of the platform is greatly affected. " Lion bright explained.

Shi Mingliang believes that the main reason for this change is "expected deterioration", and the future uncertainty of the market, new policies and external factors may lead to sudden changes in the industry.

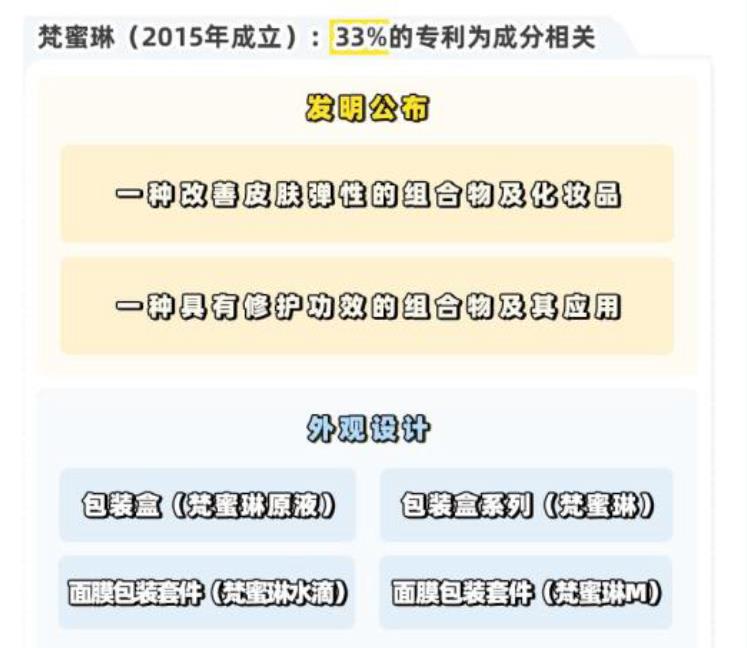

The expected deterioration has directly brought about the second change, and the supply chain and upstream enterprises have gained more attention, which is also the aforementioned R&D era. "Competition is intensifying, and enterprises have to differentiate themselves at the product end, which naturally extends to the source of the supply chain." Li Hewei said that another obvious change brought about by the intensification of traffic competition is that the competitive situation extends upstream, focusing on research and development and raw material production.

Shi Mingliang also mentioned that the integration of upstream and downstream is strengthening, changing the traditional marketing orientation, and now focusing more on R&D orientation or product strength orientation to enhance competitiveness. "In the past, factories may be owned by factories, brands by brands, and channels by channels. Now it may be the integration of factories, brands and channels, and brands with integrated production and marketing will be more competitive."

In the past few years, the development of brands has also brought prosperity to supply chain enterprises. Under the background of expected deterioration, supply chain enterprises have become more stable. Shi Mingliang believes that this also explains the transfer of capital to the upstream supply chain, the rapid development of the upstream supply chain, and more and more supply chain enterprises seek listing.

As an upstream supply chain enterprise of freeze-dried mask sub-brands, Weibo Haitai has cooperated with L ‘Oré al, Betaine, shanghai jahwa, Yiyi Herbal Medicine, Baiqueling and other brands. Li Hewei has positioned Weibo Haitai as a technology-driven raw material company, and as the company behind the brand, it has also begun to enter the public’s field of vision in recent years.

The third change is that in 2022, the make-up market showed an obvious downward trend, consumers paid more attention to skin care, and cosmetics as a whole bid farewell to high growth, but the sub-sectors ushered in rapid development.

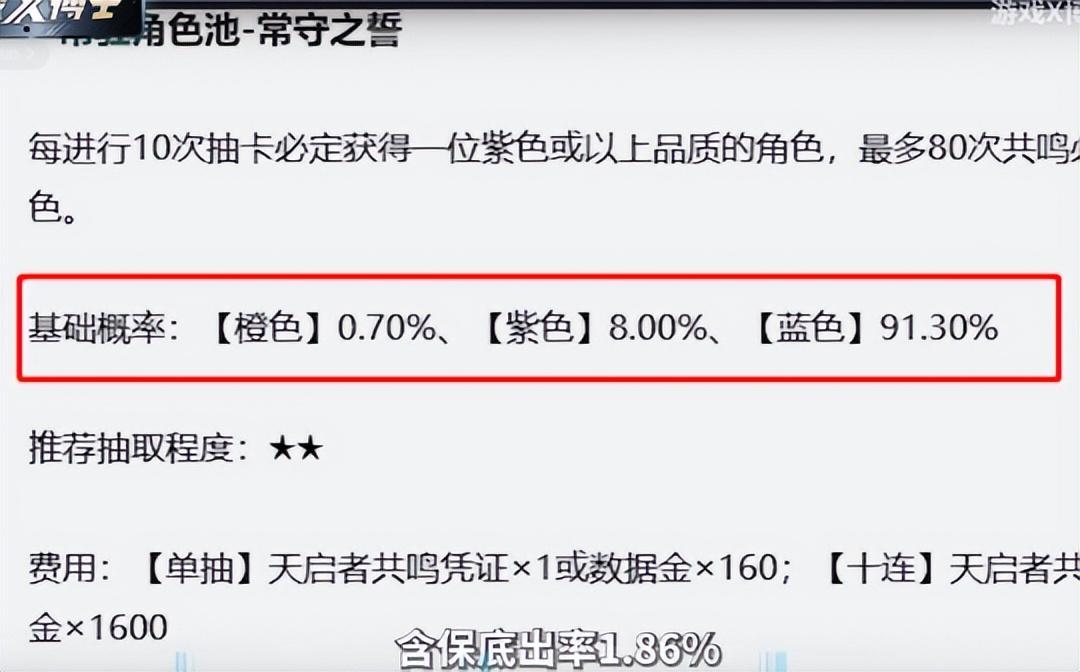

According to the data of cosmetics retail sales of National Bureau of Statistics, in 2021, the total retail sales of cosmetics in China was 402.6 billion yuan, an increase of 18.41% over the previous year, which was the largest increase in the total retail sales of cosmetics in China in the past eight years. However, according to the latest main data of the total retail sales of social consumer goods in July 2022, the total retail sales of cosmetics from January to July was 216.1 billion yuan, down 2.1% year-on-year.

Source: National Bureau of Statistics.

In fact, since the beginning of this year, the total retail sales of cosmetics has shown an obvious downward trend. From February to June, the monthly retail sales of cosmetics increased by 1.8%, -3.6%, -5.2% and -2.5% respectively, which is far from the high double-digit growth in previous years.

In the first half of this year, Mintel conducted a survey of nearly 3,000 consumers in four first-tier cities in the north, Guangzhou and Shenzhen. According to the observation of consumers in Mintel’s report "The Impact of COVID-19 Epidemic on Consumers in China-May 2022", consumers are more inclined to buy necessities such as food and basic home care products, which are more important than beauty and personal care products.

Make-up products are no longer the primary consideration in difficult times. Consumers may downgrade to cheaper products and lower the priority of non-necessities. Consumers will choose to use up their previous stocks or even stop buying. "There is a very interesting data in our survey. Only 26% of consumers said that even wearing masks, the steps of makeup are still the same as before the epidemic, and wearing masks still has a great impact on everyone’s overall makeup." Jin Yaoting, a senior analyst at Intemin, said.

According to Mintel data, the makeup market in China is subdivided by face, lips, eyes and nails. Compared with 2021, the total sales and growth rate in 2022 have declined to varying degrees.

The epidemic has caused a local shrinkage in the cosmetics market. Liu Qianfei said that consumers’ consumption habits have changed and impulse purchases have decreased, but not all categories are declining, but structural changes have taken place.

Shi Mingliang also expressed the same view. He said that the pressure on mass cosmetics is very serious this year, especially the decline of cosmetics is obvious, but there are also new opportunities for growth, that is, the growth of segmentation areas. Focus on, functional skin care, Light medical cosmetology, children’s maternal and child skin care, men’s beauty cosmetics and other sub-sectors have increased significantly.

According to IT Orange, the number of investment events in the cosmetics industry in the domestic primary market from 2018 to 2021 was 37, 38, 70 and 113 respectively, and the number only increased, but from the beginning of 2022 to the end of August, the number of investment events in the cosmetics industry was only 17. Among these 17 investment events, production, supply, research and development, skin care and men are the key words of the enterprises that have been invested.

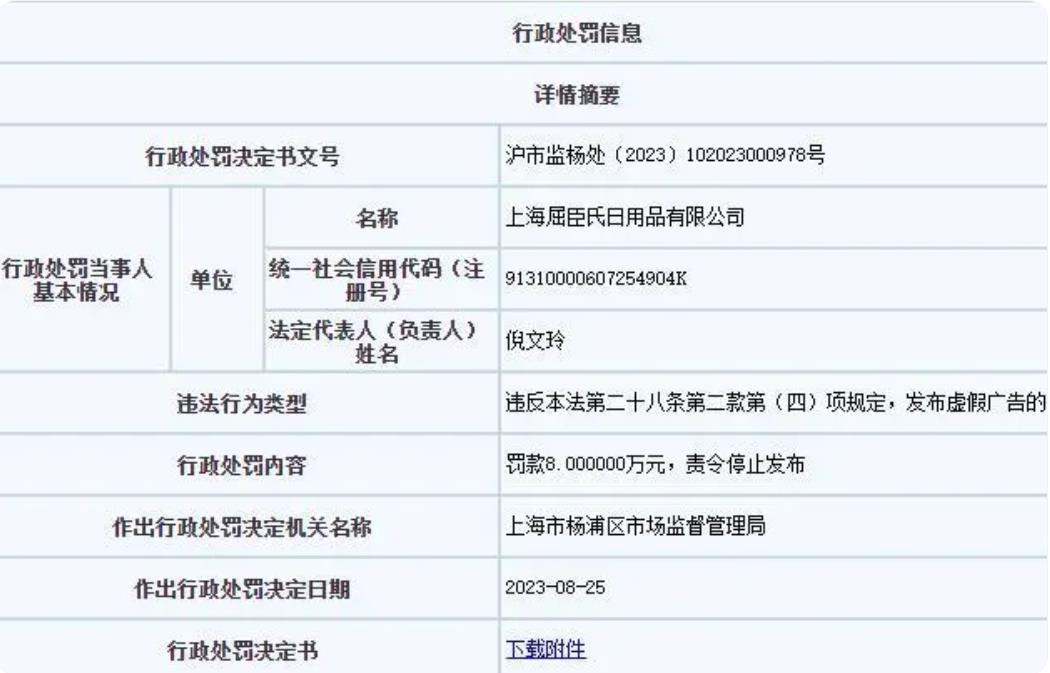

At the same time, as the executive director of China Flavor Cosmetics Association, Li Hewei is also concerned that in recent years, policies such as "Standards for Quality Management of Cosmetics Production", "Measures for Supervision and Management of Cosmetics Production and Operation" and "Regulations on Supervision and Management of Cosmetics" have been intensively promulgated, and the requirements for enterprise compliance are also improving.

national business daily