In order to better meet the people’s multi-level and diversified medical security needs and further reduce the burden of medical expenses for serious and serious diseases, Heilongjiang Province’s first inclusive health supplementary medical insurance, which is connected with basic medical insurance, has been officially launched. This product is aimed at all basic medical insurance participants in the province, regardless of household registration, age, occupation, health status, etc.

After the release of "Longjiang Huimin Insurance", it caused widespread concern and heated discussion in society. Who can insure "Longjiang Huimin Insurance"? What guarantees can be provided? How to settle claims? Relevant departments will sort out the answers for the insured.

1. Who can be insured?

Anyone who has paid for the basic medical insurance in Heilongjiang Province and is insured (the basic medical insurance in Heilongjiang Province refers to the basic medical insurance for urban and rural residents and the basic medical insurance for urban workers, including Heilongjiang provincial medical insurance, railway workers’ medical insurance, forestry workers’ medical insurance, oilfield medical insurance and agricultural reclamation medical insurance, etc.) can be insured. Regardless of age, newborns and people over 100 can be insured. No limit to household registration, no matter where the household registration is and where you live, you can have basic medical insurance in Heilongjiang. Not limited to occupations, students, retirees and high-risk occupations can be insured. Regardless of health status, people with previous illnesses can be insured and paid.

2. What is the insured price?

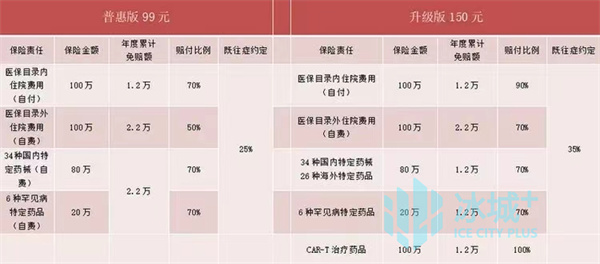

"Longjiang Huimin Insurance" products are divided into "Pratt & Whitney Edition" and "Upgrade Edition". The price of "Pratt & Whitney Edition" is 3 million yuan per person per year in 99 yuan, with the highest medical insurance; The price of "upgraded version" is 4 million yuan per person per year in 150 yuan. As long as they are insured for the basic medical insurance in Heilongjiang Province, they can pay for themselves and their immediate family members (parents, spouses and children, etc.) who are also insured for the basic medical insurance in Heilongjiang Province. Employees who are insured by medical insurance can use their personal medical insurance accounts to buy "Longjiang Huimin Insurance" for themselves or their spouses, parents and children who participate in the basic medical insurance in the province.

3. How to insure?

The insured persons of basic medical insurance in Heilongjiang Province can be insured in the following ways. Online channel: WeChat search for the official designated insurance platform "Longjiang Huimin Insurance" WeChat WeChat official account, and click "Insurance Entrance" on the bottom menu bar to insure; Search for "Longjiang Huimin Insurance" online insurance through Alipay; Search "Longjiang Huimin Insurance" for online insurance through Tik Tok.

Offline channels: China Life Insurance Co., Ltd. Heilongjiang Branch, China People’s Property Insurance Co., Ltd. Heilongjiang Branch, China Ping An Property Insurance Co., Ltd. Heilongjiang Branch, China Pacific Property Insurance Co., Ltd. Heilongjiang Branch, Sunshine Agricultural Mutual Insurance Company Heilongjiang Branch, Taiping Endowment Insurance Co., Ltd. Heilongjiang Branch, a total of six co-insurance companies offline sales channels.

4. When will the insurance take effect?

The insurance period is from September 20, 2022 to December 20, 2022, and the insured can enjoy the treatment guarantee from January 1, 2023 to December 31, 2023 without waiting period.

5. What are the guarantees for "Longjiang Huimin Insurance"?

Puhui edition99 yuan is guaranteed for one year, with a maximum of 3 million medical insurance. The guarantee responsibility includes: the hospitalization medical expenses in the basic medical insurance catalogue, the maximum guarantee is 1 million yuan, the annual deductible is 12,000 yuan, and the compensation ratio is 70%; The maximum medical expenses for hospitalization outside the basic medical insurance catalogue is 1 million yuan, the annual deductible is 22,000 yuan, and the compensation ratio is 50%; 34 kinds of domestic specific medical equipment expenses, the maximum guarantee is 800,000 yuan, the annual deductible is 22,000 yuan, and the compensation ratio is 70%; The expenses of specific drugs for six rare diseases are guaranteed at a maximum of 200,000 yuan, with an annual deductible of 22,000 yuan and a compensation ratio of 70%.

upgraded version150 yuan is guaranteed for one year, with a maximum of 4 million medical insurance. The guarantee responsibility includes: the hospitalization medical expenses in the basic medical insurance catalogue, the maximum guarantee is 1 million yuan, the annual deductible is 12,000 yuan, and the compensation ratio is 90%; The maximum medical expenses for hospitalization outside the basic medical insurance catalogue is 1 million yuan, the annual deductible is 22,000 yuan, and the compensation ratio is 70%; 34 kinds of domestic specific medical equipment expenses, the maximum guarantee is 800,000 yuan, the annual deductible is 12,000 yuan, and the compensation ratio is 70%; The expenses of specific drugs for six kinds of rare diseases are guaranteed at a maximum of 200,000 yuan, with an annual deductible of 12,000 yuan and a compensation ratio of 70%. The expenses of two kinds of CAR-T drugs are guaranteed at a maximum of 1 million yuan and the reimbursement ratio is 100%.

6. Does the previous medical history have an impact on insurance?

Past medical history, as the name implies, means that the insured has a past medical history. In the past, commercial health insurance generally did not allow people with past medical history to take out insurance, or even if people with past medical history were allowed to take out insurance, the related expenses of past medical history would not be paid. "Longjiang Huimin Insurance" breaks the restriction of past medical history. People with past medical history can not only be insured, but also the related expenses can be paid according to the agreed proportion.

Identification of people with previous diseases:

[1] Definition of the people with past illness who are responsible for hospitalization medical expenses: people who have suffered from four major past illnesses before the effective date of the policy.

Four major past diseases: (1) tumor: malignant tumor (including leukemia and lymphoma); (2) Liver and kidney diseases: renal insufficiency; Cirrhosis, liver dysfunction; (3) Cardiovascular and cerebrovascular diseases and glycolipid metabolic diseases: ischemic heart disease (including coronary heart disease and myocardial infarction) and chronic cardiac insufficiency (cardiac function grade III and above); Cerebrovascular diseases (cerebral infarction, cerebral hemorrhage); Grade Ⅲ hypertension (systolic blood pressure ≥180mmHg and/or diastolic blood pressure ≥ 110mmhg without medication); Diabetes with complications [refers to insulin-dependent diabetes (type I diabetes) or type II diabetes with local complications (including heart, kidney, cerebrovascular, retina and peripheral vascular diseases)]; (4) Lung diseases: chronic obstructive pulmonary disease and chronic respiratory failure.

[2] Definition of people with previous diseases of special drug liability: people who suffered from one or more adaptive diseases in the list of all special drugs of this product before insurance.

7. How to apply for a claim?

"Longjiang Huimin Insurance" and the basic medical insurance will be settled in a "one-stop" way, and there is no need to prepare materials and report the case. The expenses that meet the scope of protection will be settled directly after the reimbursement of the basic medical insurance, reducing the burden of the insured people on running errands. For special reasons, the insured who fails to pass the "one-stop" settlement of claims can apply for claims online by logging in to "Longjiang Huimin Insurance" WeChat WeChat official account.

8. How to find paid/pending orders?

Pay attention to "Longjiang Huimin Insurance" WeChat official account —— Click Personal Center —— Order Inquiry —— Click the Order Inquiry button in the lower right corner —— Enter the relevant information of the payer/insured to view the order. (Order payment/withdrawal can only be accessed through payer information)

9. How to check your medical insurance participation status?

Pay attention to "Longjiang Medical Insurance" in WeChat official account —— View in the service hall.

10. How to deal with the prompt "Your mobile phone number registration information does not match the payer" in the order payment link?

Guide customers to use cash payment for insurance. If customers don’t approve the cash payment method, guide the payer to download the corresponding mobile phone business hall App, and click personal information to see if it is consistent with the payer information filled in the order (name+ID number+mobile phone number must be consistent). If not, guide customers to the offline business hall to modify their personal information and wait for 3-7 working days to re-insure; If the information is consistent, provide a screenshot of the mobile phone business hall information for review.

11. In addition to provincial and municipal employees, do other employees, such as forestry workers, railways, agricultural reclamation, retired and retired personnel, also support insured identity verification and individual account payment?

At present, everyone can participate in the insurance except the farmers. The insurance entrance for agricultural reclamation personnel will be opened soon, so please look forward to it.

12. There was no medical insurance in 2022. Now I buy medical insurance in 2023. Can Huimin Insurance be purchased?

Can be purchased.

13. How to calculate the reimbursement rate for medical treatment in different places?

(1) For the medical expenses that fall within the scope of this insurance after the insured has gone through the basic medical insurance referral outside the province or has an emergency treatment in another place, and has been treated in a designated medical institution outside the province (only in the designated hospitals of secondary and above basic medical insurance in Chinese mainland), the proportion of compensation agreed upon in each responsibility shall be reduced by 10 percentage points accordingly (the former patients shall be reduced by 5 percentage points).

(2) If the insured is not in emergency or fails to go through the off-site referral and transfer according to the regulations, he will go to a designated medical institution outside the province for medical treatment, and the medical expenses that fall within the scope of this insurance after settlement by the basic medical insurance will be paid according to the agreed compensation ratio of each responsibility by 20 percentage points (10 percentage points for people with previous diseases).

14. Can I insure my parents-in-law?

Can be insured for people with insurable interests, and the applicant has insurable interests for the following people: himself; Spouse, children, parents; Other family members and close relatives who have the relationship of support, maintenance or maintenance; Workers who have labor relations with the insured; The insured agrees that the applicant will conclude a contract for him.

15. Can I insure offline?

At present, there is no offline method for personal insurance, and only orders can be placed through "Longjiang Huimin Insurance" WeChat WeChat official account online. If you are inconvenient to operate, it is recommended that your relatives help you to insure, or you can contact the sales staff of various insurance companies to assist in the operation of insurance.

16. How to calculate the deductible?

During the insurance period, the deductible is accumulated annually. For Pratt & Whitney products, the domestic expenses for specific medicines and equipment and the expenses for specific medicines for rare diseases share a deductible, while for upgraded products, the domestic expenses for specific medicines and equipment and the expenses for specific medicines abroad share a deductible, and the deductibles for other responsibilities are calculated separately. (Harbin Daily reporter Yu Yongzhen)

关于作者