It is always easy to attract everyone’s attention about celebrities. For example, there has been a disclosure of the salary of star studios recently on the Internet, which claims that the staff of many domestic first-line big coffee studios are not as good as the little sister of Foxconn – how is this possible! With full of doubts, the late reporter asked many people in the circle one after another, so how is the income of working for celebrities? What other benefits can you have besides being able to get along with celebrities? Is every star as wealthy as the legendary Fan Bingbing? After reading this report, maybe you can gain a lot of "posture". Shenzhen Evening News reporter, Jiang Shuangchao

|

|

literacy

What are the positions available in the Star Studio?

Assistant: Responsible for accompanying the artist to formulate and complete their daily itinerary, including booking air tickets, carrying bags, preparing clothes, serving tea and pouring water, etc. The nanny-type assistant is relatively tired and is almost like the artist’s personal nanny, coming for everything.

Publicity: Make a publicity plan for the artists, contact TV programs for their own artists to be announced, and write promotional manuscripts and contact major media for interviews. In short, try to let the world know about the existence of their artists. Once there is negative news, you have to urgently "put out the fire".

Agent: Arrange various jobs for artists, and determine the development path of artists. In addition, some studios will set up the position of executive agent, which is basically to cooperate with the agent to be responsible for the execution of performing arts activities, take artists to shows and interviews.

In addition to these three main components, a complete star studio should also include administrative and financial positions, of course, there are some exceptions, such as Ren Quan Studio has a catering industry team, Huang Bo Studio has a professional screenwriter, Fan Shang Wenjie Studio also has a lawyer (always ready for a lawsuit?), the most elusive position is Chen Kun Studio’s Visual Identity and Field Explorer – it turns out that because Chen Kun organizes the regular activities of "Walking Power" every year, he needs a strong and wild man to explore the way first.

break the news

Compared with the treatment, Fan Bingbing Studio is not as good as Ren Quan Studio

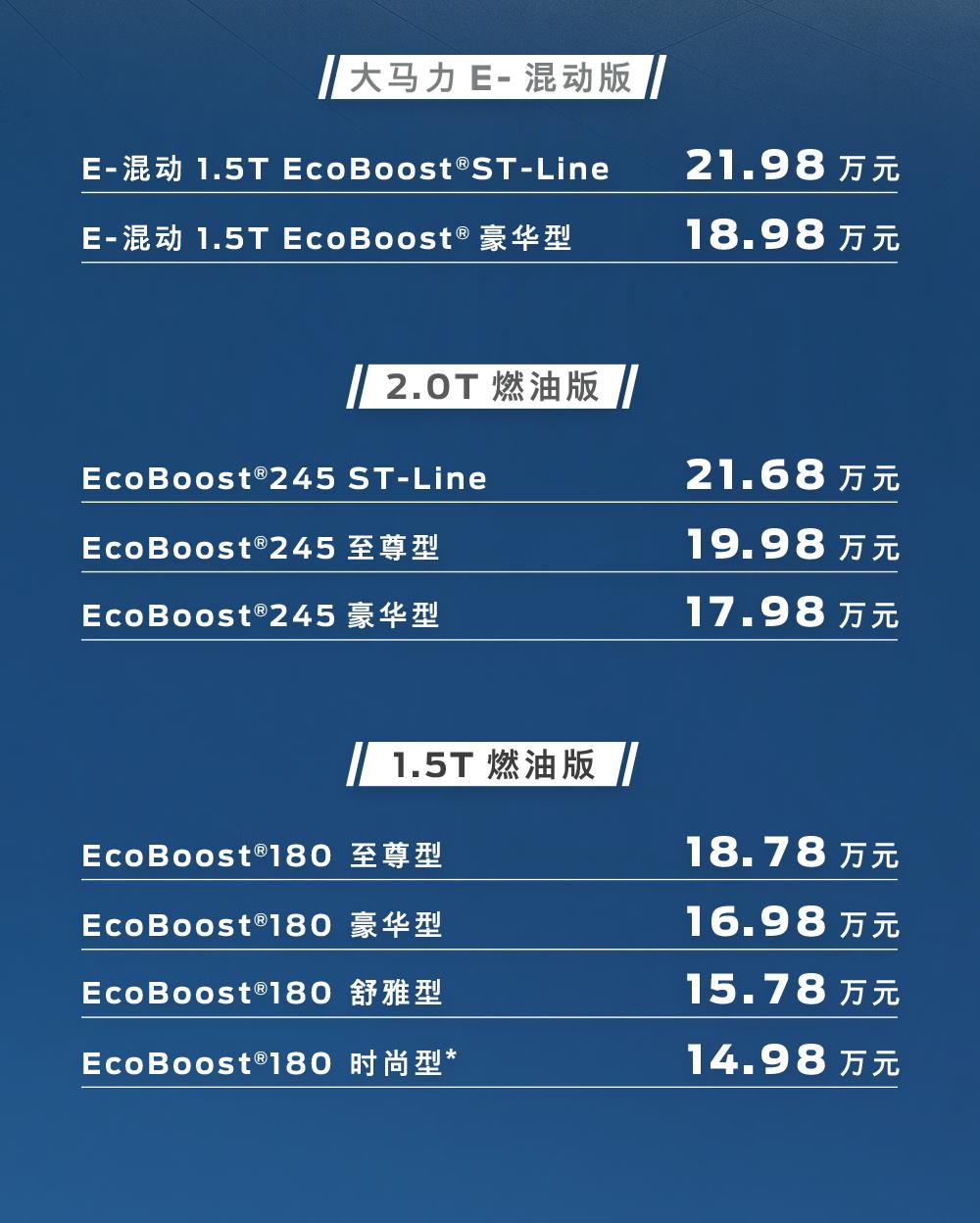

Chen Kun’s studio employees earned 1,800 yuan, Lin Xinru’s studio employees earned 3,500 yuan, and Zhang Yuqi’s studio employees earned 2,000 yuan… Recently, the so-called star studio salary disclosure sticker was circulating on the Internet, so the deep-night reporter who was shocked by this string of figures conducted some investigation and consultation, and found that working for celebrities is not that low, and of course it is not as high as everyone thought before.

Generally speaking, among the employees of the star studio, the income level is from low to high: assistant, publicity, and agent. The income of the assistant is usually around 3,000 because of the lack of technical skills. Yes, don’t look glamorous, in fact, the income is similar to that of going to the factory to work. The income of publicity will be better, roughly more than 4,000, but there are exceptions. Fan Bingbing Studio, which is rumored to have excellent treatment in the industry, is reported to have an average salary of 5,000 or 6,000. There are also some artists who may not be so popular, but the treatment given to their subordinates is quite good. For example, the treatment given by Ren Quan Studio to the staff is very good, which may be slightly higher than that of Fan Bingbing Studio. Not only does he travel at home and abroad every year, but the annual bonus is also not cheap. More importantly, his family commutes on the hour, and he doesn’t have to work hard to work overtime. In addition, the owner of artists such as Haiqing, Zhang Xinyi and Wu Xiubo – Xitian Film and Television, the general income of the publicity staff is around 4,000, but with the commission, it should reach 5,000 or 6,000. Compared with the grassroots staff, the income of the publicity director of the studio will be higher. According to the reporter, the monthly salary of the publicity director of Ren Quan Studio is more than 10,000, excluding the annual bonus.

The income of the propaganda staff is not high, but the treatment of the agent on the other side is not low. Generally, their income is also in the form of salary plus commission, of which commission accounts for the majority. For example, if you can help the artists of the studio receive film and television dramas, you can extract a certain proportion from the salary of the artist. If you receive a cost-effective job such as advertising endorsements, the commission may be as high as 5%. In this way, the general agent income is at least 300,000 or more, and there is no upper limit according to the level of the artist. However, the artist agent who can set up a studio should have an annual income of more than 500,000.

Follow the stars

What are the sweeteners?

Five insurances and one fund

Basically there are, isn’t this a basic guarantee?

Year-end red envelope

Previously, there was news that Yang Mi gave the staff 200,000 red envelope during the Chinese New Year. Although it was later confirmed to be fake news, the general red envelope can still reach five digits, but it does not rule out individual stingy bosses giving thousands and hundreds.

Paid tours, usually star studios organize trips at home and abroad every year. For example, Ren Quan’s studio went to Sanya one year.

Home plane tickets, round-trip plane tickets will be prepared for employees during the Chinese New Year, and some are full-price tickets!

contingency benefit

Compared to ordinary bosses, the bosses of the star studio were obviously more "heart-hearted". Although the salary given was not high, they would buy insurance for the relatives of the staff and pay plane tickets to visit relatives, and also give other benefits. For example, the employees of the Fan Bingbing studio would receive double red envelopes at the end of the year, one for themselves and the other for their parents.

Star Studio Q & A

Q = Deep Evening Reporter

L = old fritters in the entertainment industry

Q: Is it difficult to enter a celebrity studio?

L: If it is said that the difficulty of entering Huayi, Hairun and other entertainment companies is level 5, then the difficulty of entering the star studio is at least level 8 or above, and it is basically difficult to enter without relevant professional experience and educational background. In addition, the interview is also very important. Huang Xiaoming Studio used the world’s top 500 exam questions to test each position when recruiting, and also designed some small details on the spot to see the on-site response of the candidates. And Fan Bingbing Studio also needs to test English listening and speaking skills during the interview, which is really scarier than the college entrance examination! And the stars are also very picky. For the studio members, they basically have to interview themselves. It is said that a W male star has interviewed countless people because he wanted to find a decent-looking driver, but he has not found it yet.

Q: If you really like a celebrity, can you work for them?

L: If you are in a fan mood to work for a star, it is very likely that you will not even be able to pass the interview, let alone get in touch with the star himself. Previously, some outsiders said that many star studios could only use fans to work because of the low salary. I am very responsible to tell you – fake! For fans’ job applications, artists usually directly refuse the door. If it were you, would you be willing to keep someone who is crazy about you by your side? It’s terrible!

Q: Does the more popular the artist, the higher the studio’s income?

L: Many people think that artists have high incomes, so they will naturally throw a lot of money at the assistants and promoters around them, but please use your brains to think about it. Celebrities’ money doesn’t fall from the sky, so why give it to us at will? Of course, it is not ruled out that lavish masters like Fan Bingbing will give red envelopes from time to time, but I don’t mean to break your dream. Like us ordinary promoters, getting 6,000 or 7,000 yuan a month is already a good one in the industry.