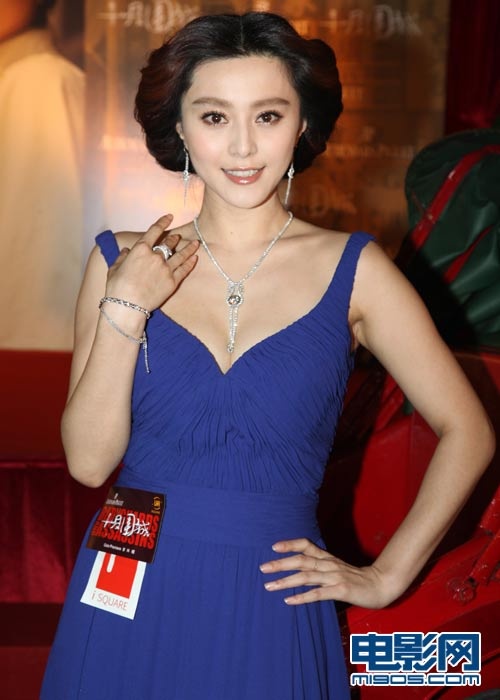

In the photo, Wang Sicong is wearing a gray sweater, black casual pants, and sports shoes. His image is particularly prominent among the crowd in suits and ties.

People who are used to the impression of the "national husband" and the "entertainment industry discipline inspection committee" may find it difficult to imagine him appearing in the government news, with a serious face and talks with local government leaders. Wang Sicong, who has disappeared from the public eye for a long time, has "returned" in this form.

On the morning of November 27, Wang Sicong appeared in Tai’an, Shandong. As the chairperson of Beijing Huanju Business Management Co., Ltd., he attended the signing activity of a cultural tourism project in Tai’an. Judging from the photos released by "Beijing Huanju Business Management Co., Ltd." on its official Weibo, Wang Sicong not only communicated with Yang Hongtao, secretary of the Tai’an Municipal Party Committee and director of the Standing Committee of the Municipal People’s Congress, but also visited related projects on the spot.

Source: Huanju Business

To put it bluntly, Tai’an City entrusted Wang Sicong to be responsible for the follow-up operation of a cultural tourism project. After the news broke, it quickly became a hot search. Some netizens speculated that Wang Sicong "is going back to Wanda to inherit the family property and will take over." Wang Sicong’s unique outfit that day also attracted the attention of many netizens. "It’s still that teenager", "maybe wearing casual clothes to meet the leader is his last stubbornness."

You know, business management and operations like this are Wanda’s strengths.When Wanda was transforming, Wang Jianlin made it clear that the restructured Wanda would be "de-real estate", transformed into an asset-light company, and become a business management company. This time, Wang Sicong took over the operation of Taishan Cultural Tourism Fitness Center, and it was the first time in the news that he had entered the cultural tourism industry. Is this move really preparation for "succession"?

In the past few years, his son’s investment career has been frustrated, and his father, who is nearly 70 years old, is still "breaking through" on the front line of Wanda. The end of the year has come to the most anxious moment.Due to the twists and turns of the listing, the fate of Wang Jianlin is about to diverge. Whether Wang Jianlin can survive this battle is still unknown. Wang Sicong, who once made it clear that he would not take over, established a business management company at the beginning of this year to regain his father’s old dream of cultural tourism. Although it is entrepreneurship, is it not another form of succession and continuation?

Appear in Shandong and enter the cultural tourism industry

Without the nightclubs, beers and Internet celebrities in the gossip camera, Wang Sicong’s image of "working hard" has once again refreshed the cognition of netizens.

"We really don’t know the situation." After hearing the news of the signing, an official from Wanda Group responded. Many other Wanda-related people speculated,This contract has nothing to do with Wanda, nor is it a "succession" action, but Wang Sicong’s own career plan."He had his own investment company," said one insider.

However, Wang Sicong’s entry into the cultural tourism industry really confused him, "I really don’t know what their thinking is?"

According to the Tai’an Municipal People’s Government Network on November 28, on the morning of November 27, the signing ceremony of the Taishan Cultural Tourism Fitness Center project was held. Yang Hongtao, Secretary of the Tai’an Municipal Party Committee and Director of the Standing Committee of the Municipal People’s Congress, attended the event and delivered a speech, and Wang Sicong, Chairperson of Beijing Huanju Business Management Co., Ltd., attended the event. At the ceremony, Tai’an Urban Development Investment Co., Ltd. and Beijing Huanju Business Management Co., Ltd. signed a project cooperation agreement.

On the evening of November 27, the WeChat official account "Huanju Commercial Co., Ltd." also released the news of "Beijing Huanju Commercial Co., Ltd. held a signing ceremony with the Tai’an Municipal Government on the cultural tourism fitness center project", and published a number of close-up photos of Wang Sicong’s presence. The official account was registered on November 13, 2023, and was certified as "Huanju Commercial Management Co., Ltd." on the 16th. The IP belongs to Liaoning.

The signing news is also the first message released by the official account. Tianyancha APP shows that Beijing Huanju Business Management Co., LtdFounded on July 20, 2023, located in Beijing, it is an enterprise mainly engaged in business services. Wang Sicong is the chairperson, president Li Xin, and executive president Ding Yi. The registered capital of the enterprise is 10 million yuan.

From the perspective of penetration, "Beijing Huanju" has two shareholders: Hangzhou Cuizhan Business Management Co., Ltd., and Jiuhuan Real Estate DevelopmentCo., Ltd., the shareholding ratio is 51% and 49% respectively. Wang Sicong is the actual controller of Hangzhou Cup, and the total shareholding ratio is 31.5%.

It is understood that before the signing ceremony, Yang Hongtao and Wang Sicong had a discussion and exchange. Wang Sicong said that Beijing Huanju Business Management Co., Ltd. will take "new scenes, new gameplay, and new trends" as the starting point, and use "compound formats, multiple scenes, and in-depth experiences" as the means to build the Taishan Cultural Tourism Fitness Center project into a young force and micro-vacation destination that integrates entertainment and fitness, four-season skiing, sports cool play, youth social networking, and parent-child science popularization, so as to realize the integration of culture, business, and tourism.

"It’s really familiar words and taste, just like Wanda’s feeling, but the person who said it was Wang Sicong. "A company person who has worked with Wanda for many years said.From the perspective of business scope, "Beijing Huanju" is not the same as the "pan-entertainment empire" that Wang Sicong has built before, but it is more related to the cultural tourism business that Wanda has been focusing on.

According to the official Weibo of "Huanju Business Management Co., Ltd.", Beijing Huanju Business Management Co., Ltd. is the only trendy entertainment and scene operation company in China that focuses on immersive experiences. At present, the assets under management exceed 6 billion yuan, there are more than 70 layout projects, and more than 100 offline single stores; the business format covers cultural tourism, business, experiential consumption and night entertainment.

According to official news, the "Beijing Huanju" is mainly involved in the renovation of the stadium project of Taishan Cultural Tourism Fitness Center. According to previous reports, the Taishan Cultural Tourism Fitness Center project was listed as one of the 10 practical things to be done for the people by Tai’an City. The project plans to complete the investment of 650 million yuan in 2020, and the investment has been completed so far about 350 million yuan.

Second, the "succession" is not clear, and the career continues

From publicly available information,This Tai’an project signing is Wang Sicong’s first foray into a physical cultural tourism project.

Cultural tourism was once Wang Jianlin’s old dream. In 2017, in order to repay the loan, Wanda had no choice but to "break its arm" and sold the core projects of Wanda’s cultural tourism sector to Sunac and R & F. The main business of "Beijing Huanju" – business management and operation, is the core sign of Wanda’s business management. In the process of going around, the son extended from the concept of pan-entertainment to the entity, and a cross-border integration seemed to have followed his father’s "old path".

Wang Sicong is the only son of Wang Jianlin, Wanda’s leading business management group. As Wang Jianlin, the "man at the helm", continues to age, the succession of Wang Sicong has attracted much attention. Wang Jianlin has responded to related topics in public many times over the past decade or so. "I talked to Sicong a few times, but he was not interested in replacing me," he said. "He thought it was too difficult to manage more than 100,000 people."

Unlike the traditional succession model of "the son inherits the father’s business", Wang Sicong refused his father’s arrangement and started his own business with 500 million yuan. During this period, there were highlights and setbacks. Since the collapse of Panda TV in 2019, there have been reports that "Wang Sicong will return to Wanda and start to take over with peace of mind". However, at the end of August last year, Wang Sicong stepped down as a director of Dalian Wanda Group Inc., Ltd., and therefore rushed to Weibo’s trending topic list.

Among the "second generation" of Chinese entrepreneurs, Wang Sicong has always been the representative of freedom.

Wang Sicong was born in 1988. In the same year, Wang Jianlin founded Wanda Group. Due to his busy business, Wang Jianlin did not have much time to take care of Wang Sicong. At the age of 2, Wang Sicong started kindergarten, and then was sent to Singapore for primary school and Winchester College in the UK for secondary school. At university, Wang Sicong was admitted to the Department of Philosophy at the University of London with a perfect score of IELTS.

Looking at his academic stage alone, Wang Sicong obviously has little to do with the word "playboy". In 2009, Wang Sicong returned to China after graduating from college. He rejected his father’s planned succession arrangement, and Wang Jianlin finally made a compromise. He gave Wang Sicong 500 million yuan to start the capital, and Wang Sicong started a different life.

The entrepreneur Wang Sicong is best known for his business identity as the chairperson of Beijing Pusi Investment Co., Ltd. The company was founded in 2009 and is 100% controlled by Wang Sicong himself. According to the official website, Pusi Capital has accumulated assets under management of more than 1 billion US dollars and invested in nearly 80 projects, including Netfish Internet Cafe, 360, Hero Entertainment, Ledou Games, Yunyou Holdings, Fushou Garden, and Xiaoguo Culture.

It is worth noting that "Beijing Huanju" is a member of "Banana Project". Banana Project is Shanghai Banana Project Cultural Development Co., Ltd., established in June 2015. Its subsidiaries include Banana Entertainment, Banana Music, Banana Game Media, Banana Film and Television, and Banana Sports. The "Banana Project" aims to build a pan-entertainment industry chain and is an important manifestation of Wang Sicong’s personal interests and business ambitions in the past eight years.

After the collapse of the market, Wang Sicong’s confidence in entrepreneurship has not diminished. In the "Result of Panda Interactive Entertainment Investment Dispute Handling" announced in December 2019, Pusi Capital stated that the failure of a single project of Panda Interactive Entertainment cannot be said to be the failure of Pusi Capital and the actual controller. Pusi Capital and the actual controller will be honest and trustworthy and continue to start a business. It revealed that Pusi Capital lost 2 billion yuan on this investment.

For the past three years, Wang Sicong has been quiet in the market. Although he is 35 years old this year, he has not yet shown a clear intention to succeed. However, with an entrepreneurial vision, he obviously has a lot to do.The day after announcing the signing of the Tai’an cultural tourism project, Beijing Huanju official Weibo posted a second message, titled: Beijing Huanju Business Management Co., Ltd. – a leader in 5.0 immersive experience business.

"Unlike traditional commercial management companies, Huanju has introduced its shareholding or holding brands into the commercial complex in the form of main stores, as the engine that cannot be replicated in the complex," the article said. "At present, the commercial projects that have been launched include: Hangzhou ICON CENTER Trend Night Entertainment Complex, Queens Park Guochao Industrial Incubation Center, Meihetang Michelin Catering Center, etc."

The article concludes: Huanju is willing to join hands with everyone to support the "backbone" of future business development.

Third, Wang Jianlin is sad at the "end of the year"?

Another "second generation", Liu Chang, chairperson of New Hope Liuhe, once talked about his admiration for Wang Sicong in an interview, saying that when he started his business in the early years, he could only borrow very little money from his father Liu Yonghao. Liu Chang has long since become a model of succession. After Wang Sicong first tasted the twists and turns of entrepreneurship, he entered the physical cultural tourism industry, with more stability and caution behind his actions.

At the moment, his father, Wang Jianlin, 69, is still sailing in the wind and rain, much like the situation in "The Old Man and the Sea". In the past three years, Zhuhai Wanda Commercial Management’s Hong Kong-listed IPO has been delayed repeatedly, and the listing uncertainty has increased sharply. The more than 30 billion yuan gambling agreement signed with investors will also expire at the end of the year. Whether this crisis can be successfully resolved will determine the ultimate fate of Wang Jianlin and Wanda’s business empire.

According to The Paper, Wang Jianlin and Zhuhai Wanda tried to delay the payment of the 30 billion yuan share repurchase payment involved in the listing bet after the short-term hopelessness of Zhuhai Wanda Commercial Management’s IPO, but the initial plan was not agreed by investors. Zhuhai Wanda Commercial Management hopes to extend the repayment of the share repurchase payment to four years, while providing part of Zhuhai Wanda Commercial Management’s equity as collateral. However, investors did not accept this proposal.

According to the news, Zhuhai Wanda Commercial Management also stressed that if it can obtain regulatory approval and the market conditions improve, Zhuhai Wanda Commercial Management may still be listed before the end of this year. Wanda Group responded that the listing of Zhuhai Wanda Commercial Management is still in progress.

In the past three years, Zhuhai Wanda Commercial Management has submitted prospectuses to the Hong Kong Stock Exchange four times, the most recent being on June 28 this year. Shortly before, on June 2, the International Department of the Securities Supervision Commission issued a request for supplementary materials for the filing of overseas issuance and listing of Zhuhai Wanda Commercial Management, and asked to respond to six questions, including dividends, internal control, whether the rental rate is accurate, the risk of debt repayment by controlling shareholders, and the use of listing proceeds raised.

In fact, in 2021, Zhuhai Wanda Commercial Management IPO has been "small road" by the Securities Supervision Commission, and the approval of overseas IPO has been accepted by the China Securities Supervision Commission, entering the substantive stage of IPO in Hong Kong. To successfully list on Hong Kong stocks, Zhuhai Wanda Commercial Management needs to obtain "big road". Up to now, the Securities Supervision Commission has not officially issued the approval of Zhuhai Wanda Commercial Management H-share issuance.

"The current liquidity and valuation of the Hong Kong stock market are low, and even if it is listed, it will be a huge loss for investors," said a securities market person. Zhuhai Wanda’s commercial management investment team is "star-studded", including Ant, Tencent, Country Garden, Country Garden Services, CITIC Capital, CITIC Securities, Warburg Pincus, China Merchants Group Capital, United Life Insurance, Shanghai Guosheng Capital, Zheng Yutong Family and other investors.

Under the combination of multiple pressures such as the continued downturn in the operating environment, the maturity of the company’s debt, and the blockage of the IPO, Wang Jianlin has not had a good year this year.According to public information, so far this year, Wanda has put some of its Wanda Plaza, financial licenses, Infront Sports, film company equity, etc. on the shelves.

In terms of cash flow and debt, Wanda is still under pressure. As of the end of the first half of this year, the balance of Wanda’s commercial management cash and cash equivalents was about 14.70 billion yuan, a significant decrease of 53% year-on-year. In addition, the consolidated caliber interest-bearing liabilities were about 141.30 billion yuan, of which the interest-bearing liabilities due within one year were about 29.30 billion yuan. Due to the impact of Wanda’s commercial management public market refinancing channels not being restored and the listing progress of its subsidiary Zhuhai Wanda was less than expected, bond prices fluctuated further. This means that,The difficulty of refinancing in Wanda’s open market has increased.

Recently, it has been reported that Zhuhai Wanda Commercial Management intends to postpone its IPO time in Hong Kong until 2026 at the longest, and is currently in discussions with investors. This is two years later than the rumor that "Zhuhai Wanda Commercial Management may choose to IPO in 2024" exposed at the end of October. Wanda officials have not yet said anything about this. If the news is true, Wanda Commercial Management will be exchanged for a longer opportunity to build momentum.

At the moment, how to convince investors will be Wang Jianlin’s biggest headache.