Since 2015, China’s new energy vehicle production and sales have ranked first in the world for seven consecutive years. In October, China’s new energy vehicle production and sales completed 762,000 and 714,000 vehicles respectively, an increase of 87.6% and 81.7% year-on-year respectively, and the market share reached 28.5%. The production and sales of new energy vehicles and the export volume of automobiles have both reached a record high, continuing to drive the stable growth of China’s automobile production and sales. With the rapid popularization of new energy vehicles, China’s automobile industry has ushered in the focus of the double-cycle bankruptcy and the excellent opportunity of "changing lanes and overtaking". It is necessary to give full play to its advantages, tap the potential of domestic demand and external markets, and then cultivate new advantages for China’s new energy automobile industry to participate in international cooperation and competition under the new situation.

At the 2022 China (Tianjin) International Automobile Exhibition, which officially opened on November 10, new energy brands are coming to the exhibition with a new product lineup and cutting-edge technology concepts, allowing visitors to enjoy the latest new energy vehicle development achievements and future development trends at one time.

The 2022 China Tianjin International Auto Show showcased a total of 990 exhibition vehicles, of which 260 were new energy vehicles, accounting for nearly one-third of the proportion. Compared with the previous exhibition, the proportion of new energy vehicles on display this year has increased. In recent years, with the country positioning the new energy automobile industry as a national strategic emerging industry and launching a series of supportive policies, combined with the domestic supply chain advantages, China’s new energy automobile industry has led the world in an all-round way. With the increasing emphasis of enterprises on new energy vehicles, many traditional car companies have launched independent new energy brands. In the process of the strong rise of China’s new energy automobile brands, many enterprises have taken active actions and embarked on the "new and upward" path in the level of brand culture and product upgrades.

Smart car

As a new user-oriented automotive technology innovation company jointly created by SAIC Motor Group, Zhangjiang Hi-Tech and Alibaba Group, Zhiji Automobile brought its first "New World Driving Control Flagship" Zhiji L7 and mass-produced concept car AIRO to the Zhiji Automobile booth in Hall S9, bringing users the peak choice of electric and intelligent new world.

With its product strength and subversive experience for users, Zhiji L7 shows the charm of the "treasure model". The only "four-wheel steering + hybrid tire width" in the same class makes the "driving control ceiling" clear at a glance; the "more human-like" intelligent driving experience makes the smart driving strength that shakes the world’s top players indisputable; the 180 + net taste level health cockpit refreshes the "new benchmark for air quality"; the high value of "long in the user’s aesthetic point" makes people fall in love at first sight and unforgettable.

In addition to Zhiji L7, the mass-produced concept car AIRO also interprets a new picture of the future of smart electricity for the audience. Zhiji AIRO is the first cross-border car circle created by Heatherwick Studio, a partner of Zhiji Auto Brand. With the vision of creating "the home of future travel life", AIRO makes natural and smooth ripple shapes flow in the user’s aesthetic point in the form of art, revealing that "technology and art coexist and parallel, and are an inevitable choice for creating future life".

Ruilan Automobile

Ruilan Automobile, which entered the new energy vehicle market with the differentiated advantage of power exchange, landed at the 2022 China Tianjin International Auto Show with a number of blockbuster models, setting off a new trend of power exchange and accelerating its progress to the C-end market as a "power exchange light travel popularizer".

The Ruilan 9, which has just been pre-sold worldwide, is a full-size pure electric SUV with a long wheelbase of 2825mm and a reasonable layout of 6/7 seats. It performs perfectly in space, bringing people a more comfortable and exclusive driving experience. It also supports a dual-supplement mode of 60-second non-inductive power change and 30-minute DC fast charging, providing users with more flexible fuel options.

Another "pure electric 6-seat MPV" Rui Blue Maple Leaf 80vPRO has a large driving space of 1798L and a maximum luggage volume of 1198L, flexible 6-seat space and 23 storage spaces, making the driving experience comfortable and pleasant.

The Rui Blue Maple Leaf 60sPRO sedan, with its fast-back streamlined body, gives the impression of elegance and atmosphere without losing a sense of movement. The interior focuses on an eco-friendly cockpit, using high-quality eco-friendly cockpit materials and ergonomic eco-leather seats, with 17 flexible storage spaces, which not only enhances ride comfort, but also brings a stylish and elegant sensory experience.

AITO

AITO made a stunning appearance with the Q & A series. The Q & A series was jointly designed by Cyrus Automotive and Huawei to continuously enrich the product matrix and bring a new smart driving experience to more consumers. The Q & A M5 is the first model of the Q & A series. It is positioned as an intelligent luxury electric drive SUV. It adopts the ultimate design to create a luxury aesthetic. The pure electric drive range extension platform gives it the ultimate performance, bringing a long battery life of more than 1100 kilometers in full fuel and a 100-kilometer acceleration of 4.4 seconds.

Q Jie M7 is positioned as a smart luxury large electric SUV, focusing on family users, IKEA IKEA. It meets the needs of comfortable travel with humanized technology, adopts a 2 + 2 + 2 three-row six-seat space layout, and the original six-in-one range extender powertrain expands the forward space of the passenger compartment. With 23 storage spaces at 14 places in the whole car, it creates ample space for the whole family. In particular, it is equipped with the industry’s first commercial AITO zero-gravity seat to create a luxurious riding experience.

It is worth mentioning that all products of the Wenjie family are equipped with HarmonyOS smart cockpits, which gives the product a smart technology experience. Not only can you enjoy the ultimate smooth, easy and natural interaction experience, but also enjoy rich car and machine applications and convenient cross-device connectivity. It can also make the smart cockpit often new through OTA.

Niutron

The luxury medium and large-scale city exploration SUV Self-Traveler NV has a pure electric version and an extended range version, with a pure electric + extended range dual powertrain to meet the needs of multiple scenarios. Thanks to the GEMINI twin power module system developed by Mars Stone Technology, the Self-Traveler NV is fully compatible with both pure electric and extended range drive modes. The new car is equipped with an iAWD dual-motor intelligent four-wheel drive system as standard, equipped with a high-efficiency permanent magnet synchronous motor. The three-electric system integration and motor power density ratio lead the same level. The acceleration time of 0-100km/h for all models can reach 5.9s.

The self-traveler NV extended range version of WLTC has a comprehensive cruising range of 939km (CLTC comprehensive cruising range exceeds 1257km) to meet the needs of users for long-distance intercity travel; at the same time, the extended range version of the model has a pure electric cruising range of 150km (WLTC condition), which is convenient and efficient for daily commuting in the city. The self-traveler NV pure electric long-range version of CLTC has a cruising range of 560km, and at the same time provides a pure electric standard cruising version with a cruising range of 440km in CLTC condition to meet different user requests. In terms of intelligent driving, the self-traveler NV is standard with 24 AAD high-order auxiliary driving system functions such as AEB (automatic emergency braking), ACC (full-speed domain adaptive cruise), BSD (blind spot monitoring), and LCA (lever lane change), which have a high degree of safety and stability.

Landmap

Lantu brought its "performance-level intelligent electric SUV" Lantu FREE family models and "electric luxury flagship MPV" Lantu Dreamer series models to the auto show. Among them, Lantu FREE, Lantu FREE ultra-long battery life pure electric version and Lantu Dreamer models all made their debut at the Tianjin Auto Show.

Lantu FREE Standard Edition is labeled "Perfect Balance, Value Benchmark", perfectly balancing performance and intelligence, super power brings 4.5 seconds of acceleration experience, with high-quality driving control, high-quality comfort, and high-quality safety, fully meeting the daily needs of users in different scenarios. Lantu FREE DNA shows more pioneering design and powerful performance. It inherits the performance gene of Lantu FREE, adding multiple aerodynamic designs, zero hundred acceleration to 4.3 seconds, and is currently one of the most powerful SUVs in China.

At this year’s Tianjin International Auto Show, Lantu Auto also unveiled the Lantu Dreamer seven-seat version and the private customized version (four-seat) model simultaneously. Lantu Dreamer was born from ESSA’s native intelligent electric architecture. Its zero-hundred acceleration takes only 5.8 seconds at the fastest, and the longest battery life is 750km, bringing 0 anxiety travel experience. The Dreamer private customized version is based on Lantu’s official personalized customization ecology. It is the only official customized electric MPV with rear-mounted customization. It has 3 exclusive color schemes for the interior, which can realize more personalized and exclusive customization needs for users.

Nezha car

Based on the first landing model created by Shanhai platform, Nezha S was officially launched for pre-sale on July 31. Resonant with the ever-changing user requests, Nezha S shows the exclusive style of "Sports Smart Enjoy Coupe" with high intelligence and high performance hard power, and brings a new driving experience to the majority of users with the core values of sports, technology and youth.

Nezha S is equipped with industry-leading hardware, luxury and comfortable configuration and leading intelligent level. It also comes standard with the NETA PILOT 3.0 intelligent driving assistance system developed by Nezha Automobile, so that the intelligent experience can benefit every user. In addition, Nezha S also has the body size of B + class car, the rare Hozen-EPT 4.0 thermal management system and high-performance heat pump system of the same class, the rare chassis texture within 300,000 yuan, the ultra-low 0.216Cd wind resistance coefficient of the same class, the rare large central control screen within 300,000 yuan, and the sky sound effect brought by the 720 ° Nezha custom surround sound. It has become the "best coupe within 1 million yuan".

Hechuang Automobile

As the title partner of the EDG Hechuang Automobile Team, Hechuang Automobile has fully integrated the advantageous resources of the stock, joined hands with a number of leading cutting-edge technology enterprises, and injected elements such as e-sports and Guochao, aiming to make new energy smart vehicles the best entry point for linking multiple scenarios and intelligent ecosystems.

Hechuang A06 is the first model based on Hechuang’s self-developed H-GEA global pure electric architecture. It is equipped with a fully upgraded H-VIP 2.0 intelligent driving interconnection system, truly realizing the beautiful vision of "technology serves people". It adopts Hechuang’s new vector aesthetic design language, has a trendy and dynamic appearance and 0.217Cd ultra-low wind resistance; the whole system is equipped with Qualcomm 8155 chip, equipped with a new self-developed car system HI-OS, to achieve a 3-second fast boot experience.

Hechuang Z03 is a trend smart driving pure electric SUV co-created by Hechuang, EDG and users. It takes "combat aesthetics" as the design concept and shows the future attitude. The car is equipped with an H-VIP intelligent language control system, which can voice-control the vehicle in a simple sentence. At the same time, it develops cutting-edge technology of automatic valet parking to respond to the needs of users’ full-scene intelligent travel. As a car brand that is deeply co-created with users, Hechuang has teamed up with world-class e-sports team EDG and Dingliu Guoman "Lingcage" to bring "blood" from the inside to the end, bringing an immersive car feast that integrates future, technology and cross-dimensional for Generation Z users.

NIO NIO

NIO brought all the main models (ES8/ET7/ES7/ES6/EC6) and this year’s much-anticipated NIO ET5 to the scene. Rich colors and model combinations, especially the ET5’s annual color (Mirror Air Powder/Cloud Early Yellow), satisfied the audience’s curiosity and expectation for all NIO models.

"I’ve heard of it, I’ve never seen it" at the NIO exchange station airborne car exhibition site. The original closed bottom structure of the exchange station has been transparently treated, and the power exchange process has been demonstrated in real time at multiple times on site, allowing friends to feel the real energy replenishment speed of "full power start, only one song time". In addition, the on-site display area of super-charging piles, fast-charging piles and home-charging piles 2.0 is also set up to learn about the complete energy replenishment experience of NIO cars that can be charged, exchanged and upgraded.

At the same time, the NIO Center has also moved into the car show site. Visitors can experience NIO vehicles, replenish energy, explore the NIOLife Surprise Mall, or go to the NIO Café to taste a variety of NIO special drinks. The car owner exhibition area can also see the artworks of NIO car owners, or take children on a journey of exploration and creation at Joy Camp.

In addition, NIO has also prepared 3 special live broadcasts of the auto show. Partner car owners and volunteers – NIO pre-sales and after-sales system employees, take everyone to the exhibition without leaving home "cloud"! Explore the best car purchase policy, surprise interactive gifts, hard core vehicle knowledge, city general manager connection and other exciting content throughout the year.

Zero car

On September 28, 2022, Zero Run Auto held an immersive press conference of "Zero Run C01 Advanced Life C" online. Under the witness of thousands of Leaper, Zero Run C01, the latest flagship model of Zero Run Auto, was officially launched, opening a new journey of multi-scene intelligent luxury electric cars.

The five versions of Zero Run C01 only have the difference between battery capacity and single and double motors, and all the other 80 intelligent luxury configurations are fully loaded. The whole system comes standard with 28 high-precision sensing hardware and 23 intelligent driving auxiliary features, which fully cover the appearance and interior, intelligent interconnection, entertainment audio and video, safety protection and humanized configuration. It will be equipped with standard equipment to easily enjoy the car ownership experience of "entry is high equipment".

The Zero Run C01 is equipped with a large-capacity power battery, and the CLTC comprehensive operating conditions have a cruising range of up to 717km, which is enough to meet the needs of multi-scene and long-distance travel. It can be called an artifact for users and their families to travel. With the self-developed OurHours AI BMS intelligent battery management system, the power battery can be controlled throughout its life cycle, making every trip more secure.

As the brand’s flagship model, Zero Run C01 showcases the latest achievements of Zero Run’s global self-research, which will greatly meet the current user’s multi-scenario car needs. Its leading 5 C-bit hard power will also completely change the market landscape of medium and large sedans, redefining the new value of medium and large sedans.

Geometric car

Based on the pursuit of personalized in-vehicle intelligent experience by new users, Geometry Auto has launched two models, Geometry G6/M6. The new car is equipped with a super-electric intelligent cockpit developed based on HarmonyOS, which once again raises the upper limit of user intelligent experience, and detonates users’ demand for diverse and scene-based travel with "true intelligence" and "true safety".

Geometry G6/M6 builds a high-value intelligent cockpit environment for users, realizing a seamless switch between driving and life and a seamless connection of intelligent experience. At the same time, Geometry G6/M6 has a "3-second boot" experience, and 8G + 128G "hard core" configuration ensures that the car-machine app is synchronized with the driver’s behavior, and the running speed is "second" to the same level.

Geometry G6/M6 brings the L2-level intelligent driver assistance system to the only standard of the same level, and rich application scenarios make novice drivers no longer afraid to go on the road. At the same time, the standard super-electric intelligent cockpit of Geometry G6 and Geometry M6 can not only bring users a smoother, more convenient and richer super-electric intelligent cockpit, but also bring the upgrade of entertainment methods and user experience, so that the car changes from a simple means of transportation to a life partner, and the vehicle realizes the expansion from a simple driving space to an entertainment space, a social space, and a leisure space, becoming the core carrier of the "third living space".

Avita

Avita Technology brings its first product, Avita 11, with its good-looking, easy-to-drive and really smart product charm, to offer fans and consumers in Tianjin and even North China a new travel feast brought by the world’s first "emotional intelligent electric coupe SUV".

As the first product born in the "new generation of intelligent electric vehicle technology platform – CHN", Avita 11 empowers the three giants of Changan Automobile, Huawei and Ningde Times in their respective fields, integrates the three characteristics of "new architecture, strong computing and high-voltage charging", and leads the new track of intelligent electric vehicles (SEV) with strong product strength of value ceiling, comprehensive performance ceiling and intelligent ceiling.

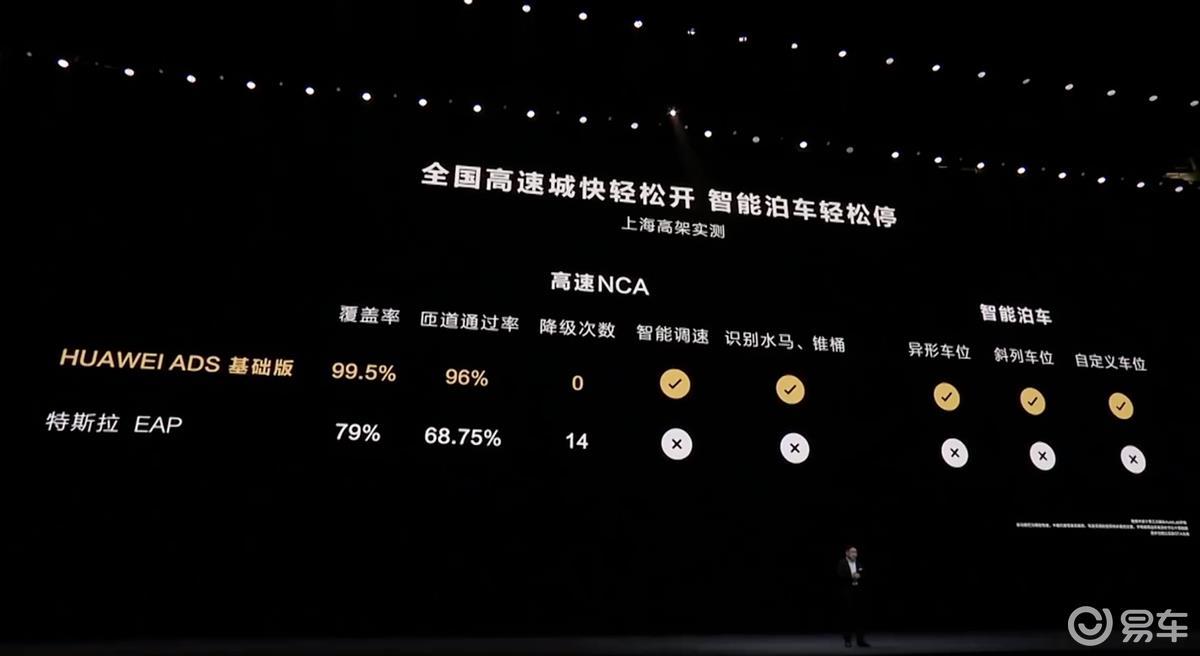

In-depth cooperation with Huawei, Avita 11 has become the first model in the world to come standard with HI Huawei’s full-stack smart car solution. Equipped with 34 smart driving sensors including 3 lidars, and using a high-performance intelligent driving computing platform, it brings consumers AVATRANS intelligent piloting system including high-speed NCA smart driving navigation assistance, urban NCA smart driving navigation assistance (through OTA open user subscription), APA automatic parking assistance, RPA remote control parking and other functions, achieving full scene coverage in high-speed sections, urban sections and parking links.

Voyage car

The high-end new energy luxury brand Yuanhang Automobile of Dayun Group was officially unveiled.

Yuanhang Y6 is positioned as a D-class super luxury sedan, which is luxurious and intelligent, and adopts a driver-centered design concept. The 17.38-inch oversized central control screen is located in front of the driver and extends above the center console. It is full of technology and integrates all operation functions in the car. The number of physical buttons is extremely small, simple and generous.

The Yuanhang Y7 is positioned as a D-class sports limousine, which is full of extraordinary charm in an instant. The sculptural side lines, depicting the charming waist line and light posture, are unforgettable. The interior layout of the Yuanhang Y7 is extremely sporty, showing a sense of simplicity and openness. Precision sports car-grade ergonomic design, tailor-made for the enduring driving experience of Fengchi Electric Engine.

The Yuanhang H9 is positioned as a large sports luxury SUV. The novel design of spoiler front skirts and side panels makes the Yuanhang H9 not only sporty, but also unique. The car is equipped with 256-color variable ambient lights and 20-level brightness adjustment, which can intelligently change according to the driving mode, breathing mode, flowing water welcome mode and music rhythm mode, so that the car presents a completely different atmosphere tone, creating an excellent driving experience that coexists with passion and comfort, impact and calmness.

HiPhi

Hi-Hop unveiled its dual flagship models, the evolvable supercar SUV HiPhi X and the digital life GT HiPhi Z.

The HiPhi X is based on the three breakthrough concepts of "scene-defined design, software-defined car, and co-creation of defined value". It is the world’s first mass-produced open electronic and electrical architecture H-SOA super electronic and electrical architecture for vehicle applications, becoming an evolvable supercar SUV. The extreme handling and supercar-level dynamic performance demonstrate the personality of HiPhi X. The vehicle is equipped with a dual-motor high-efficiency powertrain. Thanks to the blessing of dual 220kW motors, HiPhi X has a 100-kilometer acceleration time of 3.9 seconds. The world’s first evolvable high-performance active forward-looking dynamic chassis can monitor and analyze the current road conditions and user driving habits in real time, and make precise control of the vehicle.

The HiPhi Z, the second flagship digital life GT of Gahe Automobile, continues Gahe’s long-standing TECHLUXE ? technology luxury DNA. As a technology luxury smart coupe, the HiPhi Z is a future car dedicated to contemporary "young" creators. Electronic age control gives the HiPhi Z excellent performance. The HiPhi Z is equipped with front and rear high-performance dual motors, with a single motor power of up to 247kW and a torque of 410Nm, achieving a 100-kilometer acceleration time of 3.8 seconds. Its 120-degree CTP battery pack is industry-leading in power and energy density, and can provide a maximum CLTC range of 705km.

concentration

Jidu ROBO-01 Lunar Exploration Limited Edition has completed Jidu’s debut at the auto show. As a joint model of the lunar exploration project launched by Jidu and China Lunar Exploration, in order to fit the theme of lunar exploration, Jidu has used star porcelain white as the exclusive body color of the ROBO-01 Lunar Exploration Limited Edition "Moonlight Skin", and it is embellished with the exclusive gold spray paint of the lunar exploration spacecraft. With the silk screen printing of the "LUNAR EDITION" icon and the multi-layer varnish process, it has greatly enhanced the uniqueness and product value of the limited edition. The addition of the "China Lunar Exploration" LOGO logo and the 21-inch aerodynamic wheel hub lunar exploration elements allows the joint elements to be presented panoramic, showing their individuality in the chic.

In the field of intelligent driving that Jidu owners are most concerned about, with the help of Jidu’s leading Point-to-Point Pilot Assistance PPA (Point to Point Autopilot) function, ROBO-01 Lunar Exploration Limited Edition will have high-level intelligent driving capabilities of high-speed, city, and parking "three domains". Under the condition of ensuring user safety, high-level intelligent driving for complex road conditions in urban areas will be realized, as well as driving experience with full scene coverage in high-speed sections, urban sections, and parking links. At present, Jidu has launched high-level intelligent driving scenario diversification in Beijing and Shanghai, and will ensure that the official version of PPA will gradually cover core cities across the country with the industry’s leading efficient R & D rhythm.

Li Auto

The Ideal L8 was officially launched on September 30, and is available in two models: the L8 Pro and the L8 Max. The Ideal L8 is available in four standard colors of metallic paint: gold, silver, gray, and black, as well as three special edition car paints: purple special edition pearl paint, green special edition pearl paint, and blue special edition cold light paint. This year’s auto show Li Auto brought a color special edition pearl paint.

The ideal L8 Max comes standard with the ideal AD Max intelligent driving assistance system. The dual NVIDIA Orin-X computing power chips equipped with the ideal AD Max intelligent driving assistance system have a total computing power of 508TOPS, making the intelligent driving system operate more stably. It can efficiently process the fusion signals of high definition cameras, lidar, millimeter wave radar and ultrasonic sensors in real time. In the future, this system will realize the intelligent driving assistance function of the whole scene.

The ideal L8 is equipped with a four-wheel drive system composed of a 1.5T four-cylinder range extender and front and rear dual motors, with a combined maximum power of 330kW, a peak torque of 620N · m, and a 100-kilometer acceleration time of 5.5 seconds. The battery pack has a capacity of 42.8kWh, and the CLTC pure electric battery life is 210km. The CLTC battery life can reach 1315km under full oil and full power conditions.

Xiaopeng

Xiaopeng G9 is positioned as a medium and large pure electric SUV model. It is based on the X-EEA 3.0 electronic and electrical architecture and is the first mass-produced 800V SiC ultra-fast charging platform product in China. In the future, it will achieve a 5-minute battery life of over 200 kilometers. At the same time, the new car is also the flagship model of the current Xiaopeng brand and will be equipped with a variety of intelligent configurations.

The central control part of the Xpeng G9 is equipped with the industry’s first mass-produced human-machine interaction system based on 3D UI. It adopts dual 14.96-inch high definition smart conjoined screens equipped with Qualcomm Snapdragon 8155 chips, and the new car will also be equipped with Xmart OS 4.0 UI operating system. For intelligent driving, it will be equipped with dual NVIDIA DRIVE Orin intelligent driver assistance chips, with a computing power of 508 TOPS to power the XPILOT 4.0 system. In the power part, the Xiaopeng G9 is equipped with XPower 3.0 power system, which will provide two-wheel drive single motor and four-wheel drive dual motor options. The maximum power of the single motor is 230kW (312 horsepower), and the maximum power of the dual motor is 175kW (238 horsepower)/230kW (312 horsepower), and it is matched with a ternary lithium battery, with a range of more than 700 kilometers. It is reported that the Xiaopeng G9 has two battery life versions, of which the single motor version has a range of 702 kilometers, and the dual motor version is 650 kilometers. Both battery life versions will be equipped with a 98kWh ternary lithium battery pack.

ARCFOX Extreme Fox

As a high-end luxury new energy vehicle brand in China, JIHU Auto unveiled a number of its blockbuster models with the core concept of "JIHU Technology +". The scene-based product experience and diverse user interaction forms made JIHU Auto one of the most popular brands at this auto show.

The new HI version of Extreme Fox α coefficient S brings intelligent driving to a new height. It is the world’s first production car to support high-level intelligent driving on urban roads. The new car has 34 high-sensing hardware, forming a set of 360-degree full coverage ultra-high fusion perception system, which truly restores the 3D physical world and accurately recognizes obstacles; MDC810 intelligent driving computing platform supports 400 TOPS super computing power, which can easily handle the test of complex road conditions with super brain.

Extreme Fox α coefficient T, α coefficient S standard battery life version is also an important driving force to achieve increment. Through these two new cars, Extreme Fox has greatly reduced the entry threshold of "high-end new energy vehicles", but also stirred the market of 200,000 + yuan pure electric vehicles. By passing down the purchase potential energy, it has brought more surging market vitality and given consumers more quality and price choices. Most importantly, the quality of the new car has not been reduced at all. While ensuring the core safety and core configuration, the performance of the new car’s three electricity has been greatly upgraded, which has greatly enhanced the overall market competitiveness.

AION

GAC AEP has officially released its new generation of high-end pure electric exclusive platform – APE 3.0. The platform inherits the three advantages of long battery life, large space and high safety of the previous generation, and starts a new "track" with the release of high-end product Hyper Haobo. In addition, the new AEP 3.0 platform draws on the supercar low center of gravity and lightweight body structure, so it realizes track-level rear-drive driving control, which means that it uses a rear-drive layout with higher control limits and supports the expansion of four-wheel drive systems.

Through the unique AICS intelligent chassis system, Aian can adjust the wheel output torque, braking force and suspension rigidity according to a series of parameters such as wheel speed, angle, throttle, yaw angular speed, etc., to achieve multi-system dynamic matching control, and finally make the turning radius as low as 5.3 meters. Note that this is still done in a wheelbase of nearly three meters. The steering accuracy and sensitivity have also been improved by 30%, the cornering roll has been reduced by 40%, and the braking distance of 100 kilometers is less than 35 meters.

The new generation of high-end pure electric exclusive platform APE 3.0 has the world’s fastest supercar electric drive technology, using X-PIN flat wire technology and intelligent multi-mode shift technology, which can achieve a zero-hundred acceleration of 4.9s under single motor drive. If it is a dual motor drive, it can achieve a zero-hundred acceleration time of 1.9s, with a top speed of up to 300km/h.

Feifan

Feifan Automobile made a wonderful appearance with the full sincerity of Feifan R7, an extremely intelligent high-end pure electric SUV. As the first flagship model of Feifan Automobile, Feifan R7 fully demonstrates the strength of the "Screenmaster" in the intelligent cabin industry and the "Roll King" in the intelligent driving industry with the strength of hard-core products such as the RISING MAX 3 + 1 giant screen, the RISING OS intelligent cabin interaction system, and the RISING PILOT fully integrated high-end intelligent driving system.

The RISING MAX 3 + 1 giant screen of Feifan R7 is composed of a 43-inch wide-width true-color triple screen with the largest size of a Chinese brand production model and the world’s first mass-produced Huawei visual enhanced AR-HUD head-up system, which is known as the "screen master" in the smart cabin industry. Not only is the size stunning, but also has powerful functions. The RISING MAX 3 + 1 giant screen supports four-screen linkage, which can easily realize the seamless flow of information between the main and auxiliary pilots, creating an immersive and scene-based smart cockpit experience for users. Feifan R7 is also equipped with the RISING OS smart cabin interaction system. It is equipped with the Qualcomm Snapdragon 8155 car-grade flagship chip, which has the highest single-chip computing power in the industry and the strongest brain in the rim, and refreshes the new standard of smart car interaction smart cabin. In terms of interface design, the RISING OS smart cabin interaction system adopts the Kepler style UI design aesthetic, continuing the design concept of Feifan car "not complicated, that is, extraordinary". In the truly elegant and rational design, it integrates more natural landform elements of the planet to show the romance of technology.

Euler

Euler Lightning Cat real car officially unveiled, its positioning as a medium-sized pure electric car, the shape is very retro at the same time, but also through some details highlight the sense of technology, in addition to the body also presents a dynamic back shape, the overall visual effect is very distinctive.

Lightning Cat offers a unique 10.25-inch three-barrel combination sports instrument, as well as a 12.3-inch high definition center control screen, using the Qualcomm Snapdragon 8155 smart cockpit chip. In addition, its central saddle part is equipped with multiple physical buttons and knobs, and adopts a three-spoke multi-function steering wheel. Some models also provide W-HUD head-up display function. In terms of intelligent driving functions, Lightning Cat’s high-end models are equipped with ORA-PILOT 3.0 intelligent driver assistance system, which can realize L2 + level autonomous driving.

Lightning Cat has launched single-motor and dual-motor versions this time. The single-motor version has a maximum power of 150kW (204 horsepower) and a peak torque of 340 Nm. The dual-motor performance version has a combined power of 300kW (408 horsepower) and a combined peak torque of 680Nm. In terms of battery life, the CLTC of the deluxe version and the premium version has a battery life of 555 kilometers, the CLTC of the long-range version is 705 kilometers, and the CLTC of the four-wheel drive high-performance version has a battery life of 600 kilometers.