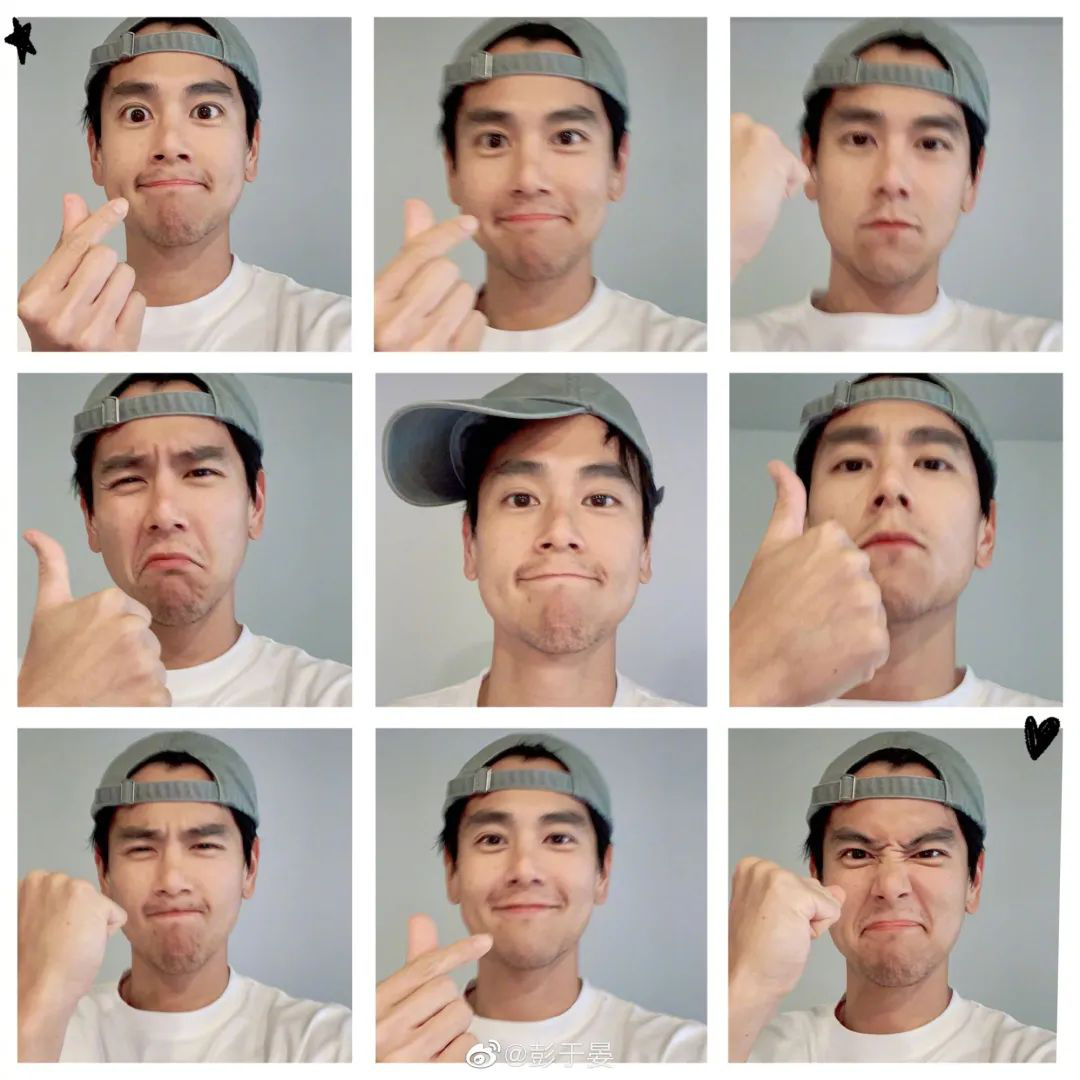

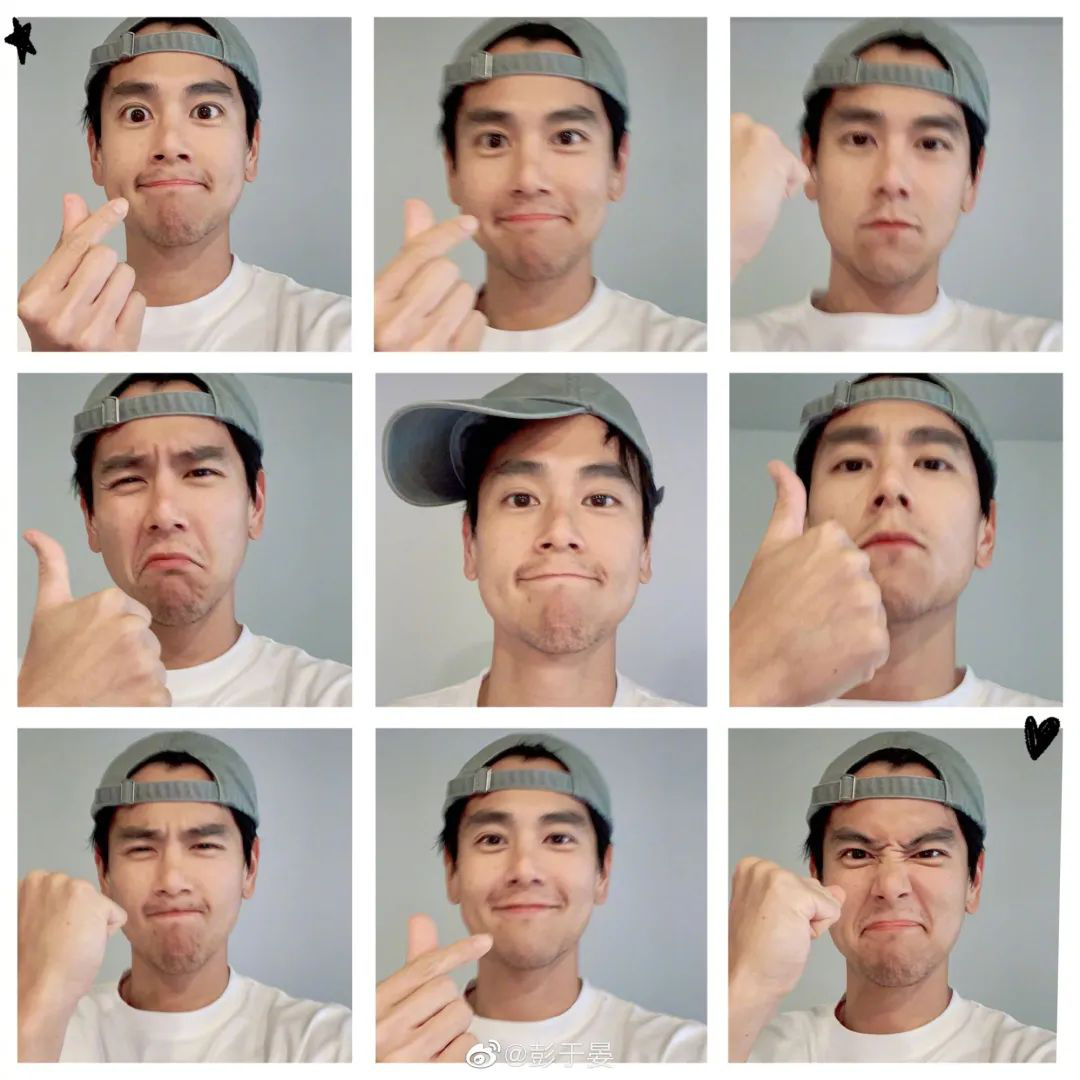

On June 12, the movie "Tropical Past" was a hit, and the star Peng Yuyan once again changed his "face" and appeared in front of the audience.

Two years ago, in the pleasant winter of Sanya, Peng Yuyan was in front and the interviewer Lu Yu was behind. The camera followed them to the coffee room of the hotel. He took out a bag of his favorite beans and cupped them for smells including "jasmine, kumquat, caramel, lemon, tea." As he recounted the coffee teacher he recently hired, he prepared to make a cup of coffee for the interviewer to taste.

This is probably the last time Peng Yuyan appeared in the public eye in a relaxed state as a non-actor. At that time, he was in Hainan for the roadshow of Lin Chaoxian’s new film "Emergency Rescue". But in private time in the early morning, he will still take the initiative to light up some "new skills", which is very sunny and very "Peng Yuyan". Like the subtropical sea breeze blowing there, people can always feel an upward force.

PHOTO

SUMMER 2021-06-21

2021

6.18

Grandma’s Fan History

SUMMER

Peng Yuyan, who is proficient in performing today, did not study acting systematically before his debut in 2002. When he studied at the University of British Columbia in Canada, he majored in economics that had nothing to do with art. Later, his debut in the idol drama "Love White Paper" seems to be a "accident" now.

The first invisible link between him and the actors came from his grandmother. Peng Yuyan remembered that his grandmother liked Hong Kong movies and Hong Kong dramas very much, and his favorite actor was "Brother Fa" (Zhou Runfa), so when he was a child, he often went to the store across the street to help his grandmother rent videotapes, and sometimes accompanied her to the cinema to pass the time.

Later, his grandmother gradually became "confused", and sometimes when she saw photos of actors she liked, she mistook him for Peng Yuyan, thinking that his grandson had also become a "star" and read "How nice." In 2002, when his grandmother died, he returned to his hometown to attend the funeral. During this period, he accidentally received an invitation from the "Love White Paper", so he walked to the camera with the mentality that it was better to show it to his grandmother.

That performance gave Peng Yuyan an unexpected pleasure. In his mouth, the performance was like a hypnosis, allowing people to break away from the shell of reality and enter another real life. Then, with the role of Tang Yu in the Xianxia drama "The Legend of Immortal Sword and Raider", he continued to quickly and effectively open up his reputation in the mainland.

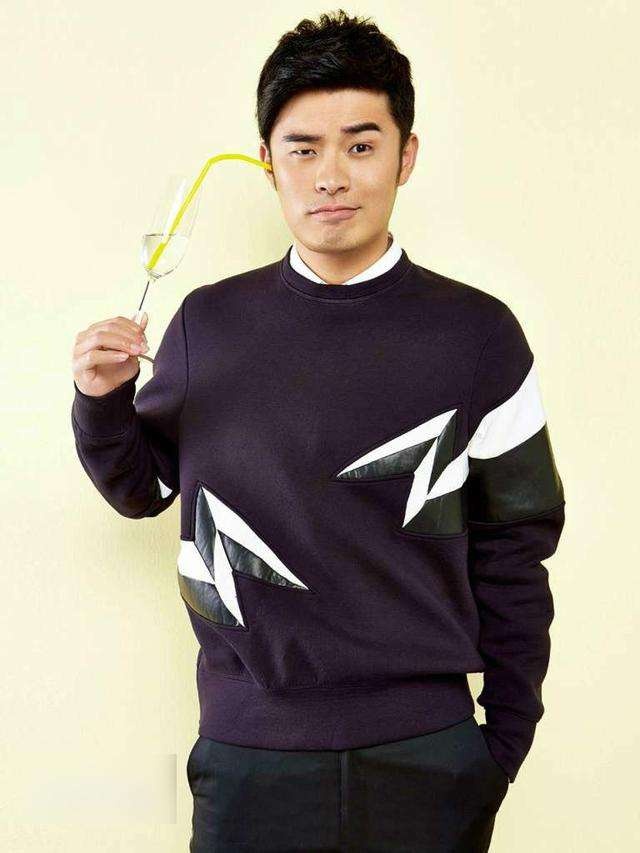

With the age, appearance, and personality of the sunshine at that time, Peng Yuyan developed into a traffic-level "idol" and captured the screams of thousands of girls, which should be very promising. But through an EP, after a little taste of singing and dancing, he seemed to have chosen a clearer direction for himself, "Because of the discovery of the record, I may still have a better chance as an actor, haha."

At first, it was indeed down the river of "idol drama" with the crowd, flowing to the double screen. But Peng Yuyan has always maintained an accurate self-awareness and correction. It is not very meaningful to chase fashion and consume himself for a while. It is better to extend his interest and see how far he can go on the road of actors.

In 2010, in the field of youth films, he had several minor works such as "Exit 6", "Love Voice Practice", "Heard", etc., but the distance between becoming a seen and recognized actor is obviously still a much broader and unfamiliar world.

The twist came with Lin Yuxian, director of "Exit 6" (Peng Yuyan’s feature debut), who was invited to play a professional gymnast, Ah Xin, in the sports film "Roll! Ah Xin" based on the personal experience of the director’s brother, Lin Yuxin.

It tells the story of A Xin, a young man with gymnastics talent, who regained his gymnastics dream and fought hard for life after experiencing a series of injuries in the rebellious period of youth. Between professional gymnasts and professional actors, Lin Yuxian finally chose Peng Yuyan boldly.

How to answer this trust? Peng Yuyan has a clear goal and does his best to become a character. In order to ensure the authenticity in front of the camera, before the movie starts filming, he starts closed training in the gymnasium three months in advance, with 12 hours of basic physical training and gymnastic movement practice every day, and the movement reshapes his body silently. At the beginning of the movie, in order to ensure that he enters the play, he insists on wearing clothes that conform to the background of the times every day, listening to Wang Jie’s songs, running with the coach, and learning athletes to strictly abide by the work and rest time.

In 2011, Peng Yuyan finally rolled his body freely in front of the camera with a bodybuilding posture that was not inferior to that of professional athletes, and the image of healthy, self-disciplined, and loving athletes seemed to have merged with him.

After the movie was released, he finally got the first screen name that the audience blurted out – "Ashin".

upward force

SUMMER

That year, "Roll Over!" put the 30-year-old Peng Yuyan in the nominations for "Best Actor" at the 48th Taiwan Film Golden Horse Awards and "Best Actor" at the 11th China Changchun Film Festival.

Sitting under the star-studded stage, he had probably secretly written his acceptance speech, which might have been mixed with a few words he wanted to say to his grandmother, but in the end, he was not selected by the spotlight and read it to everyone.

But when he pushed open the heavy door of sports type, Peng Yuyan did find a more vibrant peach blossom land. The natural relationship between "sports" and "action", "action" then led to "crime", "martial arts", "gunfight" and other elements. These hormonal screen adventures, such as the game vision map, one after another to be lit up skill points, try, invest, conquer, express, this is Peng Yuyan’s familiar and loving way of performance.

Lu Yu had aptly commented on this, "I think an actor, in the initial stage, chooses or is chosen to play some roles that are particularly difficult in the process of shaping, which is smart, because when you need to spend all your energy, physical strength, and ability to resist the hardships of the outside world, you will forget to perform, you will forget whether you are handsome or not, that is exactly the best performance."

In 2013, Peng Yuyan began his "extreme" journey. In his first collaboration with director Lin Chaoxian, he was "pushed" into the boxing ring and learned the professional moves of boxing to meat. Later, one of the fighters he fought against soon won a medal in the professional competition. The movie he and Zhang Jiahui put together with his brother also topped the box office list of Hong Kong movies that year.

Soon after, Director Lin invited him to cooperate again. He heard that this time it was a role of riding a bicycle to fall in love. He easily accepted it, but when he walked into the scene, he found that it was the blood-burning atmosphere of the top competition of the professional cycling team that was replicated over the mountains. In order to ride a professional posture, during the training period, Peng Yuyan set himself a ride of about 120 kilometers every day, and ended up riding all the mountains in Hong Kong.

After the first two high-completion trials, in 2016, director Lin Chaoxian solemnly handed over Fang Xinwu, one of the protagonists of his beloved "Mekong Action", to him. With real events as the foundation, a fierce environment, high investment, and an excellent partner, Peng Yuyan knew very well that this was a challenge that was perfect enough but also demanding enough.

"Although it’s just a movie, I need to convince myself and Brother Han Yu that when we have this belief in each other, the world will be complete. I really like living in this’world ‘."

In order to match the realistic quality of the film adaptation of this true event, he quickly mastered a number of new skills, including the use of various firearms, working with drug dogs, and parts of Thai and Burmese.

After the screening, "Operation Mekong" broke through the box office 1.10 billion and won the honor of Best Feature Film at the 31st Chinese Film Golden Rooster Awards. Lin Chaoxian, who is known for his strictness, also expressed his appreciation for Peng Yuyan in an interview: "He is doing it physically. Frankly speaking, in this environment, you can have too many choices. Are you willing to throw away other options, just do one thing, enjoy the process, and challenge yourself? I think he has this attitude."

Soul and Flesh

SUMMER

This kind of desperate Saburo-style full-hearted dedication seems to be full of emotional colors, but in fact, it is a rational force that supports the operation of the whole person.

In the words of director Jiang Wen, "He separated the soul from the body, and he used his soul to command his body. He doesn’t care how much damage, coquetry, or laziness his body has, he has to make his body look like something. Peng Yuyan is not an ordinary person. He can be very self-disciplined, and such a body is more powerful than ancient Greek sculpture."

Jiang Wen director of this recognition, from 2017 and Peng Yuyan cooperation "evil does not suppress positive", in this romantic action film, Peng Yuyan as Beiyang years of a legendary martial arts youth Li Natural, in front of the camera he and Liao Fan confrontation, and Jiang Wen, like a lively and beautiful music note, jumping in a passionate march, also running in Beiping like the eaves.

"Evil does not suppress righteousness" is a work that Peng Yuyan took the initiative to strive for among many options at the beginning, because he smelled a new challenge from the past of Beiping. If the previous performance experience is to fully mobilize the body to act, this time in Jiang Wen’s elegant era setting, he needs to learn how to use his skills to present more technical, light and agile expressions.

That year, he only concentrated on filming this one movie. He followed behind Jiang Wen and other seniors all day, studying carefully and carefully, and finally the scene of the decisive battle between him and his senior brother, which was filmed for more than 20 days in a row, constantly overthrowing and breaking through, and finally combining strength and softness, polished into what we finally saw.

After the movie was released, 583 million box office and 7.1 points Douban rating, which was a satisfactory end to this grinding experience. After that, Peng Yuyan took a quiet little vacation for himself, finally loosened the tight clockwork for a long time, stayed home, traveled, watched movies, listened to music, sorted out his thoughts, and continued to climb.

"I don’t think time exists. What you have now is what you have paid for in the past. In the future, you still have to continue to work hard. What you want to manage is not a name, but what you really want to do. You must always be full of curiosity, always brave to face the unknown." This transparent insight makes an appropriate note for him who has the courage to explore in front of the screen and who is free behind the scenes.

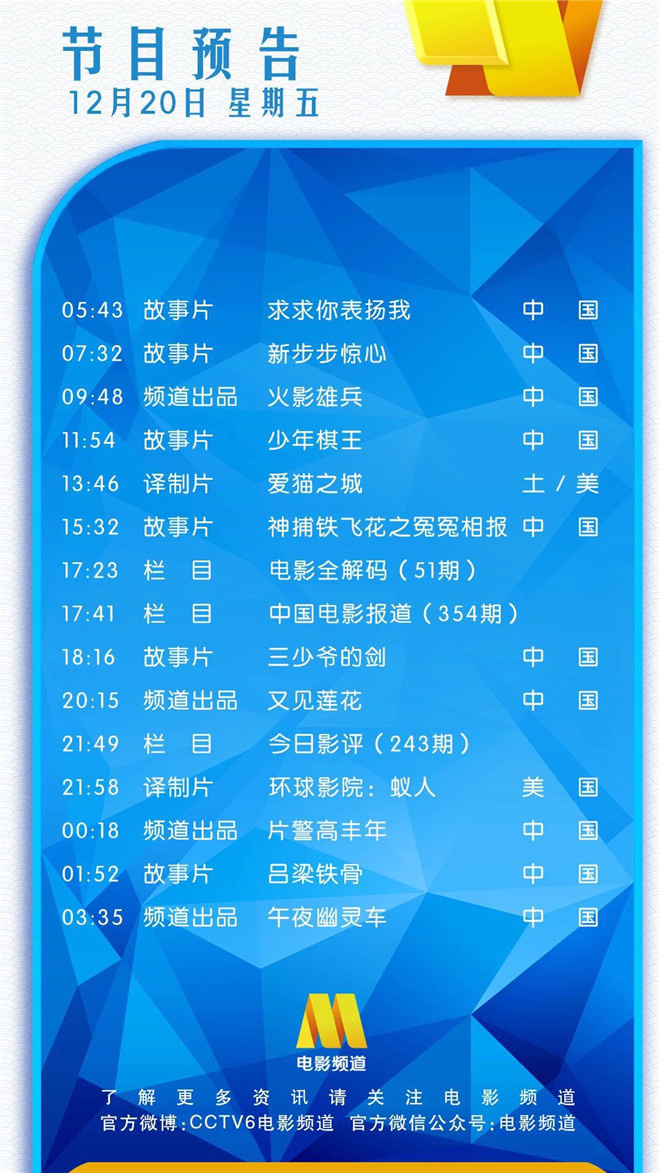

In the nearly 20 years since his debut, apart from the promotion of new films, Peng Yuyan has revealed his variety or reality show, which is almost zero. He cherishes the "one period and a while" with the audience through the screen, and also cherishes his free life as an ordinary person. When they meet, he can always report his new role name. At the end of 2020, it is "Vice Captain Gao Qian" who overcomes fear in Lin Chaoxian’s "Emergency Rescue". The movie was released during the epidemic, and the box office broke through 400 million in 8 days; the most recent one is "Wang Xueming", a thin and marginal man in Wen Shipei’s director "Tropical Past", which is still in theaters; in the future, there will be "Qiao Qiqiao", a playboy in Xu Anhua’s "First Incense".

And when we don’t meet, he is just like each of us, enjoying the most ordinary day in a corner of the city, making a cup of coffee in the morning, smelling the aroma, and sighing, the sun is so good.

NOtice

SUMMER

2021