CCTV News:Nowadays, the network world is vast and wonders. In terms of insurance types, "wonderful risks" such as exams and stickers are also emerging one after another. How much do you know about these various internet insurances? The China Insurance Regulatory Commission has issued risk warnings, and some types of insurance even have the nature of gambling and are suspected of gambling.

Network insurance set off a craze "wonderful insurance" came into being.

Before the advent of the Internet, most insurance policies covered a long period, usually in years or at least in months. However, with the popularity of smart phones, users can buy insurance products conveniently and quickly at any time and any place, and the acquisition and sales costs of insurance companies are also greatly reduced.

Since 2016, the online platform has set off an "insurance boom". In the main gathering areas of Internet insurance, there are not only traditional insurance online, such as account insurance, auto insurance, travel insurance, health insurance and accident insurance, but also the representative products of Internet innovative insurance — — E-commerce insurance.

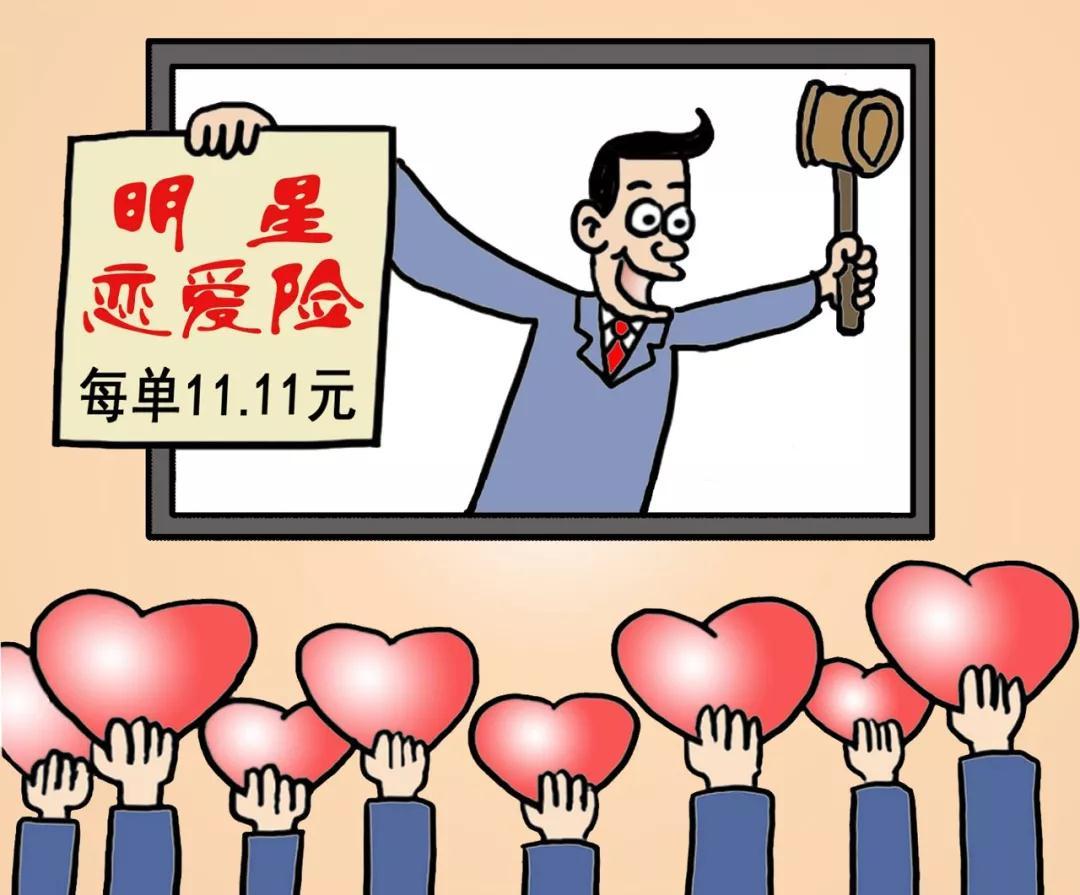

In addition, all kinds of "exotic risks" have sprung up. There are love insurance, food insurance, acne insurance for young people, overtime insurance, lottery insurance, illegal sticker insurance for office workers, and even insurance for forgetting to wear long trousers, preventing small accidents and helping the elderly, which surprised many people.

The underwriting process of product promotion is not standardized.

In July 2017, the Inspection Bureau of the China Insurance Regulatory Commission notified six typical Internet risk cases within the insurance industry. Among them, an insurance regulatory bureau in a certain place found that many well-known domestic online travel service companies with the qualification of third-party online insurance platform had problems such as nonstandard naming of insurance products, incomplete information disclosure, lack of insurance underwriting review, and failure to provide insurance documents in the process of promoting products and underwriting.

Some insurance products attract people’s attention when they are advertised and sold, such as "marriage insurance", "check-out insurance", "helping the elderly" and "Xiong Haizi insurance", but their essence is still accident insurance and liability insurance. These insurance products, whose names are simplified at will, are not only inconsistent with the regulatory requirements, but also ambiguous or misleading, which can easily lead to consumer disputes.

In addition, its underwriting process is not standardized. The underwriting interface of some third-party online sales platforms is relatively simple. You only need to enter the basic information of the insured or the insured to complete the insurance and the contract will come into effect. The insurance process has not gone through the underwriting procedures of the insurance company, and the important insurance clauses such as exemption clauses have not been explained or informed. The relevant insurance companies did not actively provide consumers with valid insurance vouchers and charging vouchers, but only informed consumers of the effectiveness of the policy and the amount of charges by SMS.

"Wonderful Insurance" is risky or suspected of fraudulent fund-raising gambling.

In fact, "wonderful insurance" itself also has many risks.

First of all, these insurance types may be suspected of fraud and illegal fund-raising, because the insurance types are not developed and sold by insurance institutions, and the insurance policies have no legal effect;

Second, because the "target" of insurance has no rules to follow, and the pricing and terms are not supported by risk data, buying such insurance is suspected of online gambling with gambling nature;

Third, the "exotic insurance" products may not be worthy of the name, which will damage the rights and interests of consumers if the terms are unclear and the relevant information disclosure of insurance institutions is incomplete and insufficient;

Finally, personal information may be lost or leaked, because the network "Qiqi Insurance" will put customers’ private data on the public "cloud" server, and sometimes there may be improper maintenance of its own information system.

The main purpose of analyzing "exotic insurance" in the industry is to "catch the eye". After all, the cake in the insurance market is so big, and most of it has been occupied by large insurance companies. Small insurance companies that can’t get the cake can only take a slant and launch some products that other insurance companies don’t have to grab market segments.

Lawyer’s statement: Strictly speaking, it is a "gambling agreement"

In view of the essence of "exotic insurance", people in the legal profession believe that in a strict sense, such a transaction cannot be called "insurance", but a gambling agreement based on personal wishes. And "Qiqi Insurance" has no insurance policy, and the online shop is a kind of existence between virtual and reality. Consumers get more verbal promises. Once the "compensation" is not implemented, it is often difficult to defend the rights of such small disputes to virtual existence.

● Regional restrictions on insurance coverage

The products purchased by insurance companies in official website are mostly restricted by regions, and cross-regional services may not be realized due to regional economic conditions and the establishment of branches of insurance companies. And some products are special products for specific regions, and even some products are different in different regions, and the insured amount is different. In addition, the insured area is not available in the whole country, and generally does not include Hong Kong, Macao and Taiwan.

● Effective time of policy.

The protection provided by insurance will be effective only after the policy comes into effect, but the effective time of Internet insurance is not uniform, and some funds will take effect immediately after successful transfer, such as flight extension insurance. Some are the same as traditional insurance, and the contract is established, and the first premium is successfully deducted and the insurance policy is issued at 0: 00 the next day, while others need to wait a few days. After online insurance, we should pay attention to whether the policy is issued successfully and the specific effective time of the policy after it is issued successfully.

● Health insurance medical treatment restrictions

Health insurance (critical illness, medical insurance, etc.) is required for medical hospitals, usually public hospitals with level 2 or above. Some products will increase the number of other medical institutions recognized by insurance companies, and only in these places can you get a claim for medical treatment. Some products will clearly list the hospitals that do not pay for medical treatment, which is subject to the insurance instructions of the insured products.

● Small self-service claims

There are two ways to claim compensation for Internet insurance. One is to call the insurance company to report the case and prepare the materials to apply for compensation at the company counter, just like the insurance purchased through traditional channels. The other is to upload the materials to the Internet and apply for compensation directly through the insurance company official website or official WeChat. For small claims, different products and different insurance platforms have different limits. If the amount of claims meets the relevant conditions, you can upload information on the mobile terminal to make self-help claims.

关于作者