Guojin Securities: Tang Chuan

The writer of this article is Mr. Tang Chuan, the research director of Guojin Securities Research Institute, and our media and Internet research team has played a small role. After obtaining the author’s consent, we are honored to forward it in the first time by using WeChat official account of the bandit group. Investors and Internet professionals are welcome to make valuable comments through messages, messages and WeChat groups!

foreword

After reading nearly 20 reports about Xiaomi, they are basically official descriptions of the prospectus, several books about Xiaomi and the reprocessing of information returned by interns from online search. There are few independent thoughts and interesting opinions.

Today’s seller research is so boring.

Xiaomi is a new species and a complex company, so it is particularly valuable for research. Our report is an attempt to re-answer some basic questions from an objective and independent perspective:

"What kind of company is Xiaomi?"

"Where is the core competitiveness of Xiaomi?"

"What impact does the Xiaomi ecological chain model have on the traditional consumer goods industry?"

Our views may be biased and debatable, but if it can lead to more in-depth thinking and discussion, this report will be successful.

We are also trying to get rid of and even challenge those recognized authoritative third-party data sources, such as IDC. We use technology to gather a huge amount of our own data, and try to spell out a more complete map of Xiaomi Empire from the clues.

As analysts, if we don’t try to evolve ourselves, we will get farther and farther away from the truth.

I am a senior rice noodle, and I like and enjoy Xiaomi’s products and services. Xiaomi is undoubtedly one of the best companies that have emerged in China in recent ten years, and has a good chance to grow into a great enterprise in the future. However, there is still a valuation between good companies and good stocks. Coupled with the pressure of early shareholders to reduce their holdings, at present we have a "reduction" rating.

The secondary market has more resources to support the long-term development of enterprises, but it also has its own rules and values and will not succumb to the valuation pressure from the primary market. For investors in the primary market, listing is a terminal for cashing out. For aspiring enterprises, listing is another place where dreams begin.

Thanks to Sun Wei, Chen Miaomiao, and the research teams of Guojin Securities Electronics, Semiconductors, Internet Media, Home Appliances and Textile Services for their support to this report!

Text of the report: running all the way’s pioneer in science and technology new consumer industry.

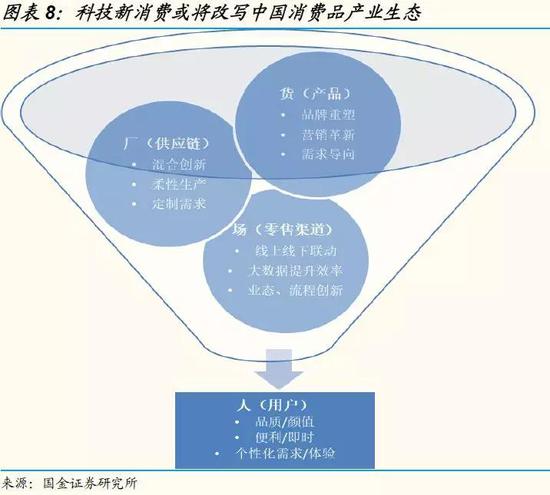

Xiaomi is a new technology consumer goods company that reconstructs the whole industrial chain of people (users), goods (products), factories (supply chains) and markets (retail channels). Based on the business model with traffic management and efficiency improvement as the core, Xiaomi has grown from a startup to a phenomenal enterprise with annual revenue exceeding 100 billion yuan in just seven years, and is actively promoting the efficiency optimization of the traditional production and marketing ecology of consumer goods in China.

Investment logic

Excellent strategic positioning ability and supporting execution are the core competitiveness. Lei Jun, the founder of Xiaomi, has accumulated many years in technology, products, marketing and venture capital, and then honed his excellent strategic positioning ability. He has successively grasped the industrial trend opportunities of smart phones and IOT, and torn open a huge market space surrounded by strong enemies such as BAT. Since the establishment of the company, the execution of the core management team in operational efficiency and cost control has become increasingly mature, ensuring that the Xiaomi model has been imitated and never surpassed.

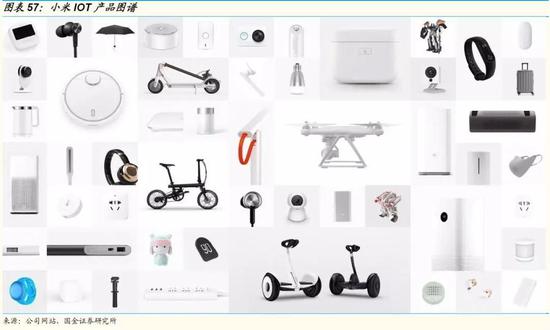

Consumer IOT business is the biggest attraction in the future.The concept of intelligent internet of things is reshaping the forms of various household appliances and daily necessities, and building new life scenes. More than 90 companies under the Xiaomi Eco-chain have launched more than 1,000 SKUs, and seized the opportunities of consumer-grade IOT by virtue of leading design concepts, efficient supply chain and traffic advantages of Xiaomi system. The unique "industry+investment" business model helps Xiaomi to superimpose equity investment income on the basis of product sales, making the ecological chain the biggest profit source of Xiaomi. We predict that more than 50% of Xiaomi’s operating profit will come from the consumer IOT business line within three years.

Towards a truly international enterprise.There is a huge market space around the world for small and high-cost products to improve industry efficiency and enhance consumer satisfaction. We believe that Xiaomi will replicate its successful experience in the Indian market and introduce smart phones, consumer-grade IOT products and supporting Internet services into more markets that are "eager for quality but have limited purchasing power". We predict that the CAGR of overseas income will reach 49.5% in the next three years, and will contribute 35% of Xiaomi’s total revenue by 2020.

Valuation and investment advice

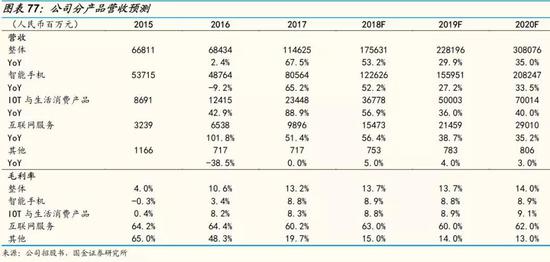

We predict that the adjusted EPS of the company in 2018-20 will be RMB 0.37/0.45/0.61 and CAGR will be 36.7% respectively. Combining the average values of three valuation methods, PEG, SOTP and DCF, we get the target price of 16 yuan for 12 months, which is equivalent to 35.9 times of PE in 2018. The first coverage is given a "reduction" rating.

List of companies

Company evolution:Founded in January 2010 and headquartered in Beijing. Xiaomi is a comprehensive technology company integrating intelligent hardware, new retail and Internet services, and also a leading enterprise in the new consumer industry in China.

Ownership structure:The company is an AB-share structure with the same share but different rights. After IPO, the total share capital of the company is 22.4 billion shares, of which 6.7 billion shares are Class A shares jointly held by Lei Jun and Lin Bin, and each share has 10 voting rights. Lei Jun is the actual controller.

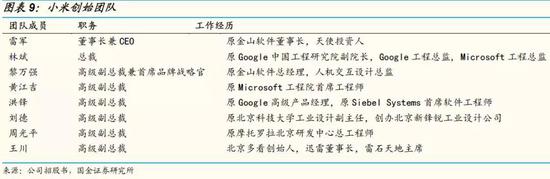

Management team:Lei Jun, the founder and CEO, is the core figure, and the core management team has many years of working experience in well-known Internet companies or technology companies at home and abroad, with outstanding overall strength.

Financing history:Since its establishment, the company has implemented nine rounds of financing, with a total amount of about 1.5 billion US dollars. The investors are basically well-known venture capital and private equity investment institutions at home and abroad. The company was listed on the IPO in Hong Kong in July 2018.

What kind of company is Xiaomi?

Should the research cover Xiaomi be an Internet industry analyst, an electronics industry analyst, or a home appliance or even a retail industry analyst? In the foreseeable future, this will be a difficult problem that puzzles the investment community.

Xiaomi’s industry ownership is not just a case. With the continuous development and deepening of the overall economy and the degree of Internet, more emerging and cross-industry enterprises without overseas benchmarking companies will emerge in China. This is also the charm of investing in listed companies in China in the future.

A correct understanding of a company’s positioning and industry attributes is helpful for fundamental research and judgment of the valuation center. So at this stage, how should we define Xiaomi?

What Lei Jun and the company’s management convey to the outside world is that Xiaomi is a pure Internet company. However, from the perspective of the company’s business structure, we believe that Xiaomi is an out-and-out technology consumer goods company. Corresponding to the fast-growing hardware business department, the contribution of Internet services to the company’s revenue has never exceeded 10% in the past three years, and even dropped by one percentage point to 8.6% in 2017. Although the Internet business contributed 39.3% of the company’s gross profit in 2017, the single-user ARPU value was only 58 yuan. Xiaomi’s Internet business line has always been tepid in social interaction, games, advertising, internet finance and other fronts, and the gap is obvious compared with the top Internet companies in China in terms of market share and influence.

However, due to the genes of the company’s founding team, Xiaomi is indeed a company with deep Internet thinking. Internet-style play with user experience as the core, traffic management as the idea and efficiency improvement as the method runs through the development process of Xiaomi. Lei Jun and his team made full use of the Internet methodology, from smart phones to consumer-grade Internet of Things products, and carried out a "dimensionality reduction attack" on the entire consumer goods industry in China, thus achieving an unprecedented achievement in the science and technology industry: operating income jumped from 0 to 100 billion yuan in just seven years.

We believe that we might as well continue to extend the concept of "new retail" in Ali.Xiaomi is understood as a brand-new high-tech consumer goods company that has opened up and reconstructed people (users), goods (products), factories (supply chains) and markets (retail channels)."New consumption of science and technology" not only refines and summarizes the Xiaomi model, but also reflects the impact and changes brought by this innovative model to the traditional consumer goods industry in China. We will discuss it in detail below.

"Excellent management team, innovative business model, complete product ecology, huge user group …" These standardized words can all be used to describe Xiaomi’s competitive advantage. However, such a description only reflects a result, not the essential reason. We believe that Xiaomi’s real core competitiveness lies in its precise strategic positioning ability and strong supporting execution.

Accurate positioning will get twice the result with half the effort.

Like many top entrepreneurs in China, Lei Jun, the founder of Xiaomi, has excellent strategic planning and positioning ability. The formation of these abilities mainly stems from his personal growth experience: from technology (the first batch of programmers in China) to products (both software and hardware are involved), from channel operation (offline software chain sales experience) to market planning (well versed in Internet marketing), from enterprise management (helping Jinshan grow and go public) to angel investment (familiar with entrepreneurial rules and connections in the capital circle) … These precious accumulations have laid the most important foundation for Xiaomi’s development.

Lei Jun’s theories of "following the trend" and "flying pigs at the tuyere" are well known to the public. Unlike the sharing economy companies such as Didi and ofo, which rely on capital to actively "build momentum", Lei Jun has been practicing Xiaomi’s entrepreneurial road with the strategy of "homeopathy". In short, he did the right thing at the right time.

Supported by the core concept of "homeopathy", Xiaomi has demonstrated its outstanding strategic positioning ability many times since its establishment, which is embodied in three aspects:

1) Look at the tuyere and go all out.In 2010, when smart phones took shape and 4G networks were not popularized, Lei Jun was firmly optimistic about the popularity of Mobile Internet, which was also the core premise of Xiaomi’s birth and product landing. Xiaomi’s English brand MI was the meaning of Mobile Internet. It’s really touching to recall that several Internet giants in China were still hesitating about whether PC-side and mobile-side traffic were competing with each other.

2) Avoid sharp edges and find a new way.In 2010, when Xiaomi was founded, the oligopoly pattern of BAT in China Internet circle has become clear. At that time, all entrepreneurs will be asked a question by investors when financing: "If BAT wants to come in and do what you want to do, how should you deal with it?" This shows the sinister ecology of Internet entrepreneurship in China. However, Xiaomi did not compete with BAT for the online entrance of mobile internet, but chose the hardware entrance of mobile phone, which abruptly tore a big hole that could accommodate a company with a market value of 100 billion US dollars from the encirclement of BAT. Among the startups in China in the past decade, only a few companies, such as Meituan and Today Headline, can do this. More importantly, Xiaomi and major e-commerce giants can still coexist mutually beneficial. Xiaomi is regarded as a supplier of traffic and content, not a direct competitor.

3) Flexible steering and permanent power.Lei Jun made it clear very early that the opportunity of smart phones is a window period of about five years. Therefore, in 2014, we began to lay out the next five-year outlet in the form of Xiaomi ecological chain: Consumer Internet of Things (IOT). In 2015-16, when the growth of Xiaomi’s mobile phone showed signs of fatigue, and the growth rate of Xiaomi’s own online traffic also showed signs of exhaustion, the smart home products of eco-chain undoubtedly played the role of "savior", which not only contributed revenue and profits, but also brought new customers and new traffic, ensuring the brand popularity of Xiaomi and even the valuation level of enterprises. Throughout the history of China’s enterprise development, few companies can successfully switch tracks, but once it is realized, it is often the embryonic form of a great enterprise.

Strong execution leads to a Ma Pingchuan.

Facts speak louder than words in the evaluation of execution. From the following three aspects, we think Xiaomi behaves like a "mature startup".

1) Efficiency of employing people.Based on Lei Jun’s reputation and connections, Xiaomi was lucky to have a strong and experienced management team at the beginning of his business. However, it should be pointed out that Xiaomi took the road of hardware products in the early days, and in the founding team of eight people, except Zhou Guangping, the other seven people have no hardware, especially the background of the mobile phone industry. Xiaomi’s core capabilities in mobile phone product design, proprietary technology (patents, chips, etc.), supply chain relationship and management are all formed while exploring. But it is such an "amateur" team that won the first place in China in four years and the fourth place in the world in seven years. We should emphasize that it is by no means easy for internet people to build mobile phones, and the bumpy fate of contemporary 360 mobile phones and hammer mobile phones is the best comparison.

2) Time efficiency."running all the way" is the evaluation of Xiaomi employees. In our investigation of Xiaomi eco-chain enterprises, we also found that Xiaomi enterprises have a strong sense of urgency. On the one hand, this is because the window period of each outlet is limited, and on the other hand, in the unprecedented fierce business environment of competition and imitation, only speed can ensure a certain first-Mover advantage. On smart phones, Xiaomi’s strategy is to reduce SKUs, focus on single items, and add a fence strategy in marketing to focus on performance explosion points in exchange for time advantages. In smart home products, Xiaomi chose a more efficient and pragmatic eco-chain strategy. Instead of doing it directly, he used the resource advantages of capital, flow and supply chain to quickly support a number of new ventures and occupy market opportunities with products with good reputation.

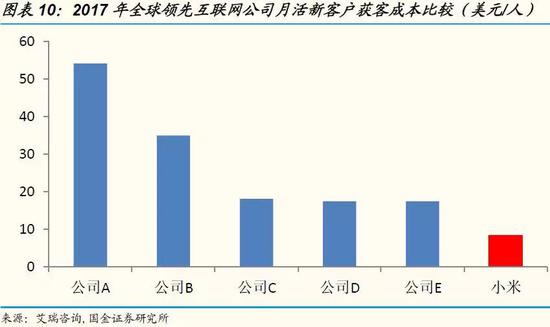

3) Cost efficiency.In 2017, the sales expense ratio of Xiaomi was only 4.6%. If the investment of offline Xiaomi House is excluded, the flow cost and customer acquisition cost of Xiaomi in the electric goods category are almost the lowest. It is no exaggeration to say that Xiaomi is the company that burns the least money but ranks among the top ten e-commerce companies in the world. This is mainly due to the early unique fan economy and social economy traffic operation mode, which helped Xiaomi accumulate a considerable number of core users at low cost by word of mouth. The cohesion and conversion rate of "rice noodles" are amazing. According to the case disclosed by the company, Yeelight, an eco-chain enterprise, can sell 40,000 smart bulbs a day on Xiaomi platform, while the same product only sells 500 bulbs a month on JD.COM platform. The Mijia APP broke through 1 billion yuan in revenue in two years without any promotion activities. It shows Xiaomi’s ability of low-cost marketing.

Xiaomi never hesitated to publicize his business model and development goals, and even published two books to explain his business logic. On the one hand, it is a part of marketing and brand marketing, on the other hand, it is indeed because the Xiaomi model is more complicated. Because of this, a lot of research and analysis on the company’s business model is only based on the company’s own description, and there is little independent observation and thinking.

An accurate interpretation of the business model helps to grasp the core variables that drive the company’s growth. We believe that Xiaomi’s business model can be summarized as follows: user demand-oriented, traffic management as the idea and efficiency improvement as the method, forming a positive cycle of spiral development.

In the early stage of development, Xiaomi’s development path was similar to Apple’s, with mobile phone items as the core entrance, supplemented by Internet services as a starting point to improve user stickiness. However, Apple has gradually built a powerful moat based on the ecosystem of IOS, which is beyond the reach of MIUI system based on Android. However, compared with Jobs, Lei Jun has a deeper understanding of the Internet and a more grounded understanding of users’ needs, thus embarking on his own path.

Because of this gene, everything in Xiaomi mode is designed around traffic.

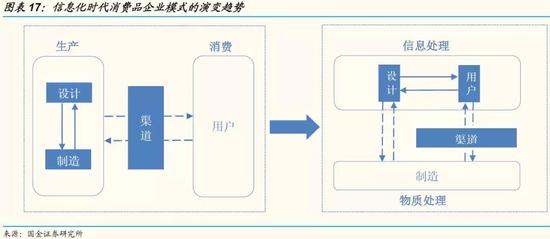

Unlike traditional consumer goods companies, which design and manufacture products first, and then build various channels for sales, the new technology consumer companies represented by Xiaomi completely build business chains around traffic (or user groups), and the core goal is to maximize traffic resources. The premise of obtaining traffic/users is to find out and supply products that meet users’ needs, and then match them with systematic value-added services to obtain the opportunity of secondary realization and strong stickiness to users.

In the direction of hardware products, Xiaomi didn’t follow Apple’s road of relying on technology and innovation to lead users’ needs, but tried to choose products that don’t take risks and don’t need to educate consumers, aiming at meeting the large-scale universal needs of low-end users, that is, the so-called 80/80 theory (meeting 80% of consumers’ needs), with the aim of ensuring a large enough user pool.

In brand building and marketing, Xiaomi understands the essence of experiential consumption, word-of-mouth marketing and viral communication, realizes the rapid expansion of traffic at a low cost, and maintains the loyalty and enthusiasm of users through core fan groups and event marketing.

In manufacturing and sales, Xiaomi is offering the efficiency methodology of the Internet. Obtain the right to speak in the supply chain through large-scale direct mining; Cut off unnecessary intermediary links in the channel through the new online and offline retail model; Finally, lower-cost production and distribution are realized, and it is beneficial to the user side in exchange for more traffic resources.

In terms of the second realization of traffic, Xiaomi has completed the first stage, that is, the ecological layout of the Internet, and built a whole system of products including games, social interaction, film and television entertainment, local life services and internet finance around the mobile phone portal. In the second stage, Xiaomi’s goal is to promote the interconnection of smart home products, build rich life scenes by using IOT platform, and realize cross-drainage among users by using big data.

In terms of new business development, Xiaomi has developed Mijia series smart homes and a series of daily necessities. The logic of these SKUs, on the one hand, is a rational extension from the periphery of the mobile phone, on the other hand, is to improve the user access frequency of online and offline channels. After all, mobile phones only belong to the category of low-frequency consumption, and we must rely on more diversified and higher-frequency categories to stimulate the number of active users and ensure the growth of traffic. This is also the biggest difference between Xiaomi and Apple.

The above aspects are closely combined,Taking users as the center, taking products, channels and services as the means, and continuously expanding users in a spiral way constitute the ultimate "drainage" solution of Xiaomi.

After entering the consumer-grade IOT business, Xiaomi really evolved into a new technology consumer company. We think it is necessary to analyze the model of Xiaomi’s ecological chain separately, because it is not only one of the important sources of Xiaomi’s profits in the future, but also the great influence that Xiaomi, as the leader of new technology consumption, has brought to the whole consumer goods industry in China.

Another clever play of smart companies

We believe that the eco-chain model is the most suitable business model for consumer-grade IOT for the following four reasons:

1) Quick.In the era of the Internet of Everything, the product form of the application side will be extremely fragmented, and there will be no more giant categories that ship 1.5 billion pieces every year like smart phones. On the other hand, IOT, like smart phones, is a trend outlet, and the window period for competing for market position is limited. Xiaomi is keenly aware that if he makes an IOT product himself like a mobile phone, he will definitely lose his first-Mover advantage in time. Therefore, the eco-chain model with investment and empowerment as the core was decisively adopted, and more than 1,000 SKUs were launched in three years, many of which became explosive products, successfully establishing a leading position in the consumer-grade IOT market.

2) It is light and heavy.Xiaomi is good at exerting his strengths to the extreme. Through the product design of the professional team in the ecological chain, plus Xiaomi’s own brand, flow and supply chain resources, we can form effective complementary advantages, and do not need to directly invest in manpower and research and development, and maintain the overall light operation mode of Xiaomi Company. At the same time, investment is also a very important mode. Through the connection of capital (generally accounting for 10-40% of the shares), eco-chain companies can be United very effectively and affect their major operational decisions. This way of re-investment is an effective barrier for competitors.

3) Optimize user groups.The mobile phone users accumulated in Xiaomi’s early stage are mainly men under the age of 35 (nearly 70% of Xiaomi’s mobile phone users are men), and cities below the second line account for about 51%. For Xiaomi, a new consumer goods enterprise determined to become the world leader, expanding into a larger user base and bringing new traffic is an important strategic goal. Since the eco-chain project has been running for more than three years, Xiaomi’s user portrait has been greatly optimized. According to the data of Analysys Qian Fan, nearly 50% of eco-chain users are non-Xiaomi mobile phone users, and the proportion of female users has also greatly increased (more than 40%). These new users are one of the main driving forces for the future growth of Xiaomi business.

4) New profit points.In addition to product sales profits, investment income is an important means of realizing the ecological chain model. Xiaomi’s 2017 financial report shows that the fair value change income from long-term investment reached 6.35 billion yuan, accounting for 52.0% of the company’s adjusted operating profit. In the balance sheet, Xiaomi’s unrealized preferred stock investment has reached 11.41 billion yuan by the end of 2017, mainly in more than 90 eco-chain enterprises and related supporting industries. Assuming that the average annual valuation of these invested enterprises increases by 100 million yuan, the fair value income that Xiaomi can include in the income statement every year will be several billion yuan. In 2018, Huami’s successful IPO in the United States (Xiaomi holds 14.6% of the shares) opened the way for the capitalization of eco-chain enterprises. We believe that the ecological chain will be one of Xiaomi’s main profit boosters in the next three years.

Answers to three questions

If the eco-chain company wants to develop its own brand, will it have an impact on Xiaomi?No. Xiaomi and Mijia mainly cover the low-end products, which means that it is uneconomical for eco-chain companies to make low-end products again. Strategically speaking, the best choice for private brands (more than 80 at present) can only be to try to cover the high-end market that Xiaomi series has not touched or the daily necessities outside 3C category.

In this regard, Xiaomi should be happy to see it. If successful, Xiaomi can collect traffic charges (many eco-chain companies’ own brands are still sold through Xiaomi’s online channels) and considerable equity appreciation income; If it is not successful, Xiaomi Ecology will have a stable supplier. For eco-chain enterprises, private brands can certainly improve the gross profit margin, but if a series of costs such as brand marketing and channel promotion are considered, it is a great uncertainty whether it can achieve the operating profit rate of 8-12% (according to the data of listed companies in the eco-chain).

Why should the ecological chain launch daily consumer products?Consumption frequency. As mentioned earlier, the Xiaomi model is based on traffic. Since mobile phones, 3C and household appliances are all low-frequency consumption, Xiaomi needs high-frequency consumption categories to boost the number of active users, ensure the traffic and brand popularity of online and offline channels, and seek opportunities for cross-selling. Users are attracted to try new household consumables such as paper towels and toothpaste when they buy household appliances from Mijia. In the future, when I come back to buy consumer goods, I will be pushed to the IOT products that are being crowdfunded in time, and this cycle constitutes an ever-developing ecological circle.

What’s the difference between Mijia Youpin and Netease YEATION model?Supply chain. In terms of category and tonality, consumers will feel that Mijia Youpin is very close to and even overlaps with YEATION. But in terms of business model, the two are very different. Netease YEATION is a real buyer’s shop, which mainly selects products, basically does not touch the supply chain, and is relatively closed, and suppliers are not allowed to use their own brands, so it is a standard Private Label model. Mijia Youpin is relatively open in brand strategy, but it has higher requirements and direct intervention influence on eco-chain enterprises in product design and supply chain. Although the SKU of Netease YEATION will increase rapidly in the short term (more than 10,000), in the long term, the quality control level of Mijia Youpin is better, the traffic cost is lower, and the profit prospect is clearer.

Xiaomi has been entering new markets through the method of "dimension reduction attack" in hardware products, and its core weapon is the improvement of efficiency. We believe that the efficiency that can be improved mainly lies in the production cost and channel cost. If any big market has insufficient cost efficiency or channel efficiency, it will become the attack target of Xiaomi ecological chain.

Unlike the highly competitive mobile phone industry (the market share of the top five brands exceeds 85%), China’s consumer goods manufacturing industry as a whole is still in a comfort zone. Take the small household appliances industry as an example. Although leading enterprises like Midea have begun to emerge after years of competition, the overall market structure is still fragmented.

On the supply chain side, except for TV, air conditioning, ice washing and other categories, the concentration of production capacity is not high and self-sufficiency, and there is no large-scale OEM like Foxconn. In addition, the existing consumer goods manufacturing supply chain has rich accumulation in molds, structural parts and production processes, but it lacks experience in chips, batteries, Bluetooth and WiFi modules required for intelligent consumer products, and has no scale advantage.

On the channel side, the price increase rate of small household appliances from the factory to the terminal is generally more than 3 times, and the sales expense rate of related listed companies is generally 10-30%, reflecting the strong position of agents and retail channels. Counting the 30 major home appliance companies listed on the A-share market, we can see that the average gross profit margin reached 26.7% in 2017, but the average operating profit margin was only 7.8%.

It can be said that there is room for the existing consumer goods industry to greatly improve its efficiency in both cost and channel, which is also the market background for the Xiaomi ecological chain to triumph in the past three years.

When more and more traditional consumer goods enterprises begin to study and imitate the Xiaomi model, we believe that the consumer goods industry in China will gradually enter a new stage of development, and the industrial value chain from manufacturing to brand to channel will be reconstructed.

From the perspective of industrial development, any industry will continue to evolve along the direction of efficiency optimization. Consumer goods enterprises in China have always been manufacturing factories, marketing teams and dealer networks. However, under the impact of new forces like Xiaomi, we can clearly observe that the industrial chain of consumer goods is undergoing great changes in all aspects:

1) In terms of channels, online traffic is highly concentrated, and e-commerce giants are oligopolistic;The general pattern of offline appliance stores, comprehensive supermarkets and shopping mall has been set, and emerging integrated formats such as Xiaomi Home and Box Horse Fresh Life belong to the extension of online enterprises to offline.

2) In terms of brand, the marketing cost of new brands is rising rapidly, while the brand life is obviously shortened.Fashion risk stands out. Based on the consideration of survival and development, start-ups and small and medium-sized enterprises began to choose to serve those Private Label platforms that occupy traffic advantages, such as Mijia Youpin and Netease YEATION.

3) In manufacturing, the development trend of intelligent consumer goods makes the consumer electronics supply chain prevail and begin to erode the traditional supply chain.Our conclusion is that the traditional integrated industrial chain model has begun to appear obvious efficiency problems, which are increasingly unsuitable for the development trend of new consumer goods.

We predict that the future consumer goods industry is likely to have a professional division of labor like the electronics industry 20 years ago, just as the semiconductor chip industry is moving from integrated device manufacturing (IDM) to Fabless and Foundry. The core logic is that when China enters the information and data society, the innovation of interaction with consumers affects the change of product design and marketing process; Manufacturing resources, marketing resources and channel resources have been redistributed, old giants have declined and new giants have risen. We believe that the professional division of labor mode will significantly improve the shortcomings of repeated waste of resources and inefficient information communication under the integrated mode, and at the same time, there are still opportunities to grow into giant enterprises under different links of "supply chain-brand-channel", such as "Foxconn" in the field of home appliance OEM manufacturing.

Back to the micro level, it is impossible and unnecessary for future start-ups and small and medium-sized enterprises to cover everything and repeat the path taken by Midea Group. A more realistic choice is to find a link that can realize one’s own value in the chain of "supply chain-brand-channel" according to one’s own endowment, so as to locate the development opportunity. In this sense, Xiaomi Eco-chain companies are mostly located in the supply chain, Mijia Youpin and Netease YEATION belong to the brand platform, and Ali and JD.COM are the owners of all retail channels in the future.

The double promotion of industrial efficiency and user experience brought by this change is the biggest contribution of Xiaomi eco-chain model to China consumer goods industry.

The meaning of new retail is not difficult to understand: a pan-retail form that links online and offline channels by means of data technology to improve user experience and improve sales performance. There are many similarities between new retail and its predecessor O2O, but with the maturity of big data, cloud computing and consumption habits, today’s new retail has the right time, the right place and the right people, and is more optimistic about the market.

The essence of new retail is to reshape the channel value chain, reduce costs and increase efficiency, and cultivate new retail formats. However, different from the current representative projects of new retail, such as box horse fresh life, super species and bingo box, Xiaomi has once again gone out of its own way.

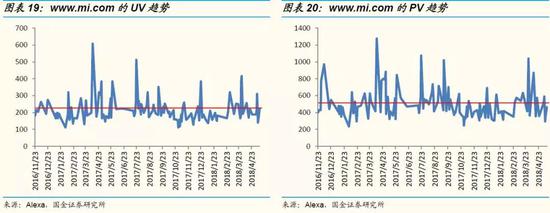

Xiaomi’s choice of new retail is also the result of "taking advantage of the trend". The core reason is that the growth rate of Xiaomi’s own online traffic has gradually declined after 2014. According to the data, the UV and PV in www.mi.com have entered a stable state in recent two years. In contrast, Huawei’s triumph in the offline channels of operators, as well as OPPO and vivo offline stores that are blooming everywhere in low-tier cities, have brought great challenges to the growth of Xiaomi’s market share. Going offline is an inevitable choice for Xiaomi to seek new sales and traffic growth points.

Judging from the layout of the business format, Xiaomi is opening a flagship store of Xiaomi House with an area of 1,000-2,000 square meters in the head city, a self-operated store of Xiaomi House with an area of 250-300 square meters in the first-and second-tier cities, a Xiaomi store with an area of 150-200 square meters in the third-and fourth-tier cities, and implementing authorized stores of Xiaomi in areas below the fourth-tier cities. It is estimated that by the end of 2018, the total number will exceed 2,000, thus completing the full coverage of the offline market in China. In addition, the first Xiaomi Youpin offline store focusing on eco-chain products opened in Nanjing in June 2018. Xiaomi’s offline layout is getting fuller and fuller.

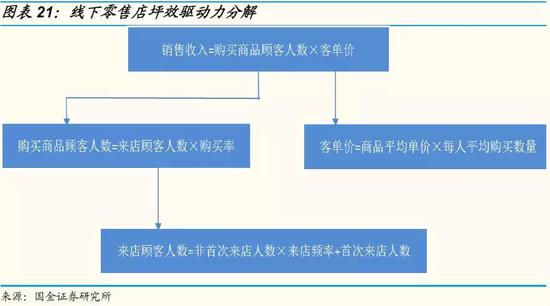

Analysis on the Income End of New Retail

Judging from the data disclosed in the prospectus, the average efficiency of Xiaomi Home under Xiaomi’s self-operated line has reached 240,000 yuan/year. According to the area of 300 square meters, it is open for 10 hours every day, and the average customer unit price is a mobile phone (including tax price in 1000 yuan). The self-operated Xiaomi House sells a mobile phone every three minutes on average. I have to say that this is a very amazing number. According to our research data, the best-selling Xiaomi Home’s annual business income including tax can reach 200 million yuan.

As can be seen from the formula in Table 21 below, the core variables that determine the floor efficiency are the number of customers coming to the store and the customer unit price. We investigated a large number of Xiaomi homes on the spot to verify the efficacy of Xiaomi’s shop. The measured results in different time periods show that the current flow of Xiaomi House is quite good. During the prime time on weekends, the 300-square-meter store can basically maintain the passenger flow of 50-100 people. In sharp contrast, Huawei, OPPO and vivo stores often open next to Xiaomi, but the traffic is generally only one-fifth or even less than that of Xiaomi. It can be seen that offline, traffic is still the core advantage of Xiaomi.

We believe that the traffic under the Xiaomi line benefits from three comprehensive effects: 1) Xiaomi brand has a good reputation and influence online. When I went offline, I attracted a considerable number of people who had heard of Xiaomi but were not familiar with it. Judging from the portraits of offline people observed, women, children and the elderly are not uncommon, and these are not fans of Xiaomi in the traditional sense; 2) In terms of site selection, Xiaomi basically chooses large shopping malls instead of roadside shops, which forms a situation of mutual borrowing with the flow of people in shopping malls. In contrast, the number of roadside stores in HOV (Huawei, OPPO, vivo) is quite large; 3) SKU with rich ecological chain plays an important role in increasing the frequency and quantity of visitors. Compared with HOV stores with less than 50 SKUs, Xiaomi Home has more than 300 SKUs, and it involves all aspects of life, forming a complete experiential life scene. This differentiation is the core competitiveness of Xiaomi’s store.

According to our survey data, the current unit price of Xiaomi House is about 500-1000 yuan, which is also an important factor contributing to high ping efficiency. On the one hand, Xiaomi’s category layout, which mainly focuses on mobile phones and smart home appliances, has a higher unit price. On the other hand, the application of big data technology is reflected in the selection of products, which is helpful to improve the purchase conversion rate. Even in the same city, the SKU of Xiaomi House or authorized store in downtown and suburb will be different. For example, in downtown stores, the high-end version of Xiaomi charging treasure is 149 yuan, while suburban stores only have the standard version of 79 yuan.

Cost analysis of new retail

Whether the new retail profit model is feasible or not, the cost is very important. According to the survey information, we made a calculation of the cost of Xiaomi House in the first-tier cities. It should be pointed out that many Xiaomi homes can enjoy certain rent concessions and government subsidies at present. But in the long run, the cost structure of Xiaomi’s store will eventually be market-oriented, so we use a more conservative assumption. In addition, for the sake of simplification, our calculation does not include the model of "which is higher in rent and income sharing" used by Xiaomi House and the shopping mall.

Judging from the calculation results, due to the extremely high efficiency of Xiaomi House at present, even under our conservative assumptions of rent and decoration costs, mature self-operated stores still have the ability to make profits. In our hypothetical situation, a single store of Xiaomi Home can achieve an operating profit rate of 5.4%. The break-even point with a total cost of 3.23 million yuan is 124,000 yuan/year.

Although with the sinking of the business format and the increase of the number of stores opened, the efficiency of Xiaomi’s stores will gradually decrease, but Xiaomi proves that it is feasible to sell online and offline at the same price under the premise of efficiency optimization. We estimate that in the next three years, the sales amount under Xiaomi line is expected to account for more than 40% of the sales amount of domestic hardware products.

Business Outlook: Challenges and Opportunities

After answering the most important strategic questions about Xiaomi, let’s analyze the three main business lines of Xiaomi, mainly discussing the future development space, opportunities and main challenges of each business.

1. Smartphones: Hard work

Smart phone is the product that Xiaomi started. Because it occupies the core entrance of the whole mobile Internet, mobile phone is the core business that Xiaomi must defend. However, as the popularity of smart phones gradually draws to a close, Xiaomi mobile phones will face many challenges in the future, and a bitter battle is inevitable.

Challenge 1: How to grasp the structural opportunities in the mobile phone market in the future?

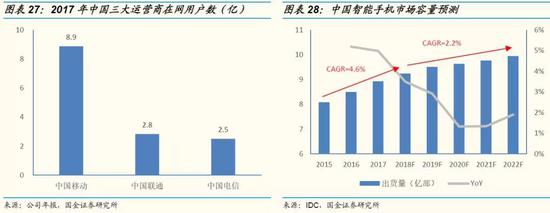

According to IDC data, there were 890 million smartphones online in China by the end of 2017, with a penetration rate of 64.5%. However, according to the data disclosed by the three major telecom operators in China, the total number of users in 2017 was 1.42 billion (which can be understood as the number of SIM cards on the network). Considering the proportion of functional machines and the scenario of one machine with two cards, we think IDC’s data is obviously too conservative. Guojin Securities Research and Innovation Center has tracked the number of smart phones in China through technical means to about 1 billion. This means that the popularization process of smart phones in China has been completed, and the growth rate of future sales will gradually decrease (IDC predicts that the shipment CAGR will be 2.2% in 2017-2022). Obviously, the opportunities of the industry will come from the demand for changing machines and the structural changes of products.

From the perspective of industry competition pattern, the top five brands account for 85.8% of the smartphone stock market in China, while the four domestic brands (Huawei, Xiaomi, OPPO and vivo) are growing rapidly, mainly eroding Samsung’s share, while Apple’s user loyalty is high and its market share remains stable. Since the mobile Internet traffic dividend has come to an end, the capital and technical strength of mainstream manufacturers are obviously superior. We believe that the smart phone market structure in China has been set, and new entrants will no longer be given any opportunities.

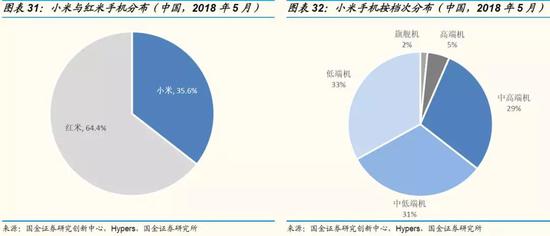

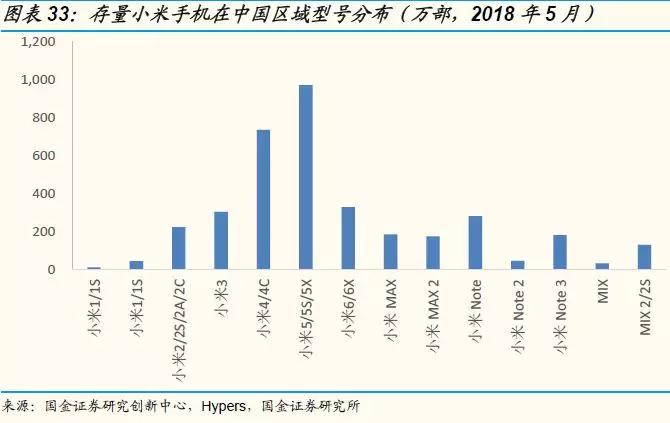

We use our own data to make a structural analysis of the existing Xiaomi mobile phone. It can be seen that the low-end Redmi series (below 1000 yuan) and the low-end Red Rice Note series (about 1000-1500 yuan) account for 64% of the historical sales, while the middle-end to high-end millet and Xiaomi Note series (1000-2500 yuan) account for 34%, while the flagship MIX series (more than 3000 yuan) accounts for about 2%. The overall customer base is obviously biased towards the low end.

From the point of view of replacement cycle, the replacement frequency of middle and high-end users is much higher than that of low-end users. Xiaomi 4C (released in September, 2015), Xiaomi 5 (released in February, 2016), Xiaomi 5s (released in September, 2016), Xiaomi 5c (released in February, 2017) and Xiaomi 5x (released in July, 2017) accounted for a total of 34% of the existing mobile phones in Xiaomi series. The distribution of existing red rice mobile phones is relatively scattered, with the old models released before 2016 accounting for 58%.

On the whole, Xiaomi’s product strategy is close to OPPO and vivo, and there are not many models on sale, but the user base is biased towards low-end users, and sales are mainly based on its own channels. With the increasing penetration rate of smart phones in China, the growth point of Xiaomi’s mobile phone business in the future will focus on whether it can take advantage of the consumption upgrading trend and gradually shift to mid-to high-end models.

Challenge 2: Where is the next step of the cost-effective model?

Xiaomi’s mobile phone focuses on cost performance. In the early stage of growth, Xiaomi took advantage of the inefficiency of other mobile phone manufacturers in manufacturing and sales processes and its own unique mobile phone shipment futures model to gain a certain cost advantage, thus successfully achieving differentiation in cost performance. However, with competitors’ research and imitation of Xiaomi model, the cost-effective advantage of Xiaomi mobile phone is being challenged more and more.

On the manufacturing cost side, a core problem is that the mobile phone supply chain tends to be centralized around the world. The bargaining power of mobile phone manufacturers for core components such as chips, memories and OLED is weakening, and it is increasingly difficult to obtain cost advantages from the manufacturing side. According to the company’s data, the top five suppliers of Xiaomi accounted for 42% of the total cost in 2017, and the largest supplier (undoubtedly Qualcomm) accounted for 14.3%, showing an upward trend. According to the data of iResearch, in the past three years, except for lithium batteries, the prices of the main components of mobile phones have not dropped significantly, and many even increased. The main reasons are the high-end trend of products and the oligopoly pattern of supply chain.

On the channel side, all major mobile phone brands have basically completed the retail channel construction of "whole network e-commerce+offline stores". To sum up, Xiaomi has certain advantages in terms of online customer acquisition cost and offline store efficiency, but it is not easy to continue to widen the gap.

We believe that Xiaomi can learn from the experience of Uniqlo, and focus on the performance of the molecular side when the denominator end of the cost performance ratio can’t be opened, and present better quality at a close price, thus continuing to maintain the cost performance advantage. Another opportunity lies in whether the channels in low-tier cities can highlight the efficiency. Recently, Xiaomi Store (Xiaomi Direct Supply Platform) is a noteworthy attempt.

Challenge 3: How to defend the innovation and leadership of products?

From the first product, Xiaomi mobile phone played the slogan of "born for fever", and quickly won a large number of users with its performance explosion points (such as the fastest main frequency, the easiest operation interface, the most advanced industrial design, etc.).

The success of Xiaomi model has aroused great concern and imitation of all mobile phone manufacturers, which has gradually weakened Xiaomi’s time advantage in mobile phone innovation. For example, Xiaomi is the initiator of the full screen. The first generation of MIX mobile phones was publicly released as early as October 25, 2016 and began to be sold in February 2017. Competing products such as Samsung Note 8, Sharp S2, Huawei Maimang 6, vivo X20 and Gionee M7 were not released until August-September 2017. However, when the new generation flagship product MIX 2S was unveiled on March 27, 2018, the catching-up pace of competitors had been significantly accelerated. Huawei P20, vivo X21 and OPPO R15 were all released in March at the same time.

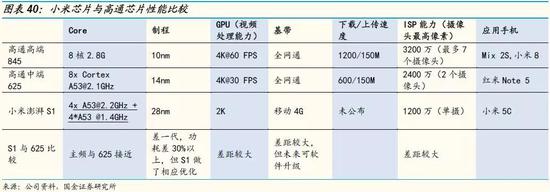

Xiaomi’s independent research and development on mobile phone chips is a positive measure to form the core technological innovation ability, but it still takes time or extended mergers and acquisitions to form effective combat effectiveness. The semiconductor research team of Guojin Securities analyzed Xiaomi’s first self-developed chip "surging S1", and compared it with that of Qualcomm. The results show that there is still a certain gap between S1 and Qualcomm midrange chip 625. However, according to media reports such as Phoenix.com and Sohu.com, the surging S2 chip will be launched soon, adopting TSMC’s 16nm process technology and eight nuclear structure (4*A73+4*A53) to benchmark the Kirin 960 processor as a whole. We look forward to the continuous progress of Xiaomi chip in the future.

We believe that in the increasingly fierce competition environment, the era when a generation of mobile phones can keep ahead for one year has passed. The innovation of mobile phone products in the future depends on the overall strength of enterprises in R&D investment and supply chain.

Challenge 4: How does the mode of word-of-mouth marketing evolve?

Xiaomi’s early marketing strategy is classic, and many cases such as "social marketing", "hunger marketing", "screaming of fans" and "sense of participation" are worthy of inclusion in business school textbooks. However, when the total number of mobile phones on the Internet exceeds 150 million and the number of MIUI users reaches 190 million, Xiaomi’s marketing means must also change accordingly with the increase of sales scale.

According to the data disclosed by the company, in March 2018, the MAU of the company’s MIUI forum reached 9 million, which is the core strength of Xiaomi fans. However, the sales of Xiaomi mobile phone exceeded 90 million units in 2017, and fans alone are not enough to support this volume. We can see that Xiaomi has begun to adopt more popular marketing strategies. Originally, Xiaomi did not have a formal brand spokesperson. For the fan group, Lei Jun is the embodiment of Xiaomi’s image. Since 2016, Xiaomi has officially launched the brand spokesperson. Xiaomi mobile phone is endorsed by Tony Leung Chiu Wai and Wu Yifan, while Red Rice mobile phone is endorsed by Wu Xiubo, Liu Shishi and Haoran Liu. At the same time, Xiaomi’s advertising efforts in TV, print and outdoor media are also much greater than before. Such a change, on the one hand, is to serve the marketing expansion needs of offline channels, on the other hand, it is also to let the brand reach a larger crowd.

After a short absence, Li Wanqiang, the chief strategic brand officer, returned to Xiaomi at the end of 2015 and led Xiaomi in a marketing turnaround in 2016-17. Li Wanqiang is a key figure in MIUI, fan community and e-commerce operation at the early stage of Xiaomi’s business. At present, he is responsible for Xiaomi’s overall brand marketing and Internet content. We believe that with the close cooperation of Lei Jun and Li Wanqiang, the road of Xiaomi from product upgrade to brand upgrade in the future is worthy of attention.

Opportunity: domestic efforts to upgrade product structure, overseas replication of past successful models.

The market structure of smart phones in China has been fixed. Although the head brands have their own strengths, the overall strength tends to be close. Any innovation in products, technology and marketing will be quickly learned and followed by competitors, and it is foreseeable that the competition in the future will be cruel. However, the traffic and user stickiness brought by the mobile phone portal are the most important part of Xiaomi’s business model and the basis for the subsequent realization of Internet services. Therefore, Xiaomi can only go all out to face the competition and continue to consolidate its market position.

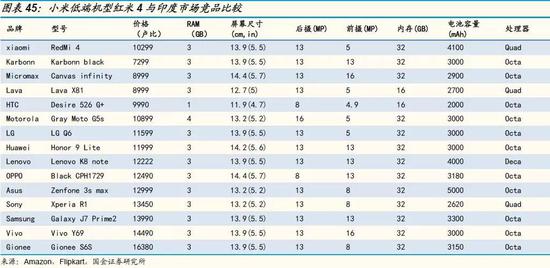

We believe that in the domestic market, Xiaomi’s opportunity lies in the upgrade of product mix driven by brand upgrade. Due to the different value chain positioning and profit rate pursuit of mobile phone products, Xiaomi’s mid-to high-end products still have certain cost-effective advantages compared with similar products of Apple, Samsung and Huawei (see Figure 43-44).

As can be seen from the analysis of Xiaomi’s network model, high-end users will change their phones for a new model, while low-end users often wait until their mobile phones can’t be used smoothly or are lost, so the replacement cycle of high-end users is much shorter than that of low-end users. This is also the reason why Xiaomi’s online models are more concentrated in the models released in recent two years (Chart 33), while Redmi’s online models are relatively scattered (Chart 34).

If Xiaomi can successfully extend from the existing user groups to acquire more mid-to high-end users, it can speed up the demand for changing machines and improve the product structure, and it can also improve the realization value of single customers, and it is also conducive to the diversion and transformation of other businesses such as IOT ecological chain and finance.

Overseas market is undoubtedly the biggest opportunity for Xiaomi mobile phone. Xiaomi products are very suitable for people who want to enjoy better quality, but their purchasing power is not high enough in terms of positioning, design, price and marketing strategy. After successful verification in the domestic market, Xiaomi has the opportunity to replicate its model in other markets around the world.

The Indian market is the first successful case of Xiaomi’s overseas expansion. Only three and a half years after the company entered the Indian market, it was convenient to win the first place in the smartphone market share in the fourth quarter of 2017. Looking back, Xiaomi successfully moved his past experience in China to India, and tactics such as "fan marketing" and "hunger marketing" attacked the city and pulled out the village in the Indian market eager for high cost performance.

We analyzed the Indian mobile phone market and drew three conclusions: 1) China mobile phone brand represented by Xiaomi has been far ahead in the Indian market. According to Counterpoint’s data, mobile phone shipments in 1Q18 India market increased by 48% year-on-year, with Xiaomi, OPPO, vivo and Huawei accounting for 45.9% of the total, Samsung accounting for 26.2% and Apple accounting for less than 2%. 2) Compared with international brands, the price of millet in mobile phone models with similar performance has obvious advantages. 3) The price of Indian local brand mobile phones is mostly below 10,000 rubles (RMB 963), but there is a big gap in performance compared with Xiaomi (mainly reflected in the memory, camera and battery life). In the future, Xiaomi is expected to continue to make great strides in the Indian market and stabilize its position as the first in the market.

On a global scale, the market that conforms to Xiaomi’s product strategy is still quite large. From the perspective of Asia alone, countries close to India in terms of market size, purchasing power level and consumption habits include Indonesia, Vietnam and Thailand, with a total population of over 450 million. These markets have similar scenes to India: the domestic manufacturing industry is weak, and smartphones are completely monopolized by international brands; There are low-priced products, but there is a lack of cost-effective products; Sales tend to traditional offline channels, which is inefficient. Although there may be some barriers to entry in technology patents, data security, government relations, etc., Xiaomi is expected to accelerate its pace in overseas markets by setting up factories on the spot and localizing products and services.

In 2017, overseas markets contributed 32.1 billion revenue, accounting for 28% of Xiaomi’s total revenue. Assuming that 95% of overseas revenue comes from mobile phones, we estimate that Xiaomi’s overseas revenue has reached about 38%. With the continuous improvement and deepening of overseas distribution, we predict that overseas market revenue will contribute 41.6% of Xiaomi’s mobile phone revenue by 2020, and CAGR will reach 45.9% in the next three years.

According to the company’s classification, IOT and consumer products departments include all eco-chain products as well as smart TVs, laptops, routers and set-top boxes. We believe that the IOT business line has the advantages of "good time" (the industrial outlet is close), "favorable location" (the competitive pattern is scattered and there is a breakthrough in efficiency) and "human harmony" (the unique operation mode of the ecological chain), which is the biggest attraction and important profit contribution point of Xiaomi in the next three years. Judging from the company’s strategic layout and development plan, Xiaomi is ready to make an all-out assault on consumer-grade IOT products and continue the glory created by the mobile phone business.

Clarify a cognitive misunderstanding first.

We agree with the general direction of the Internet of Everything in the future and the clear trend of smart home development. However, according to the results of our data monitoring, consumers in China are still in the early stage of contacting and trying all kinds of intelligent products, and the habits of users in using intelligent IOT products need to be further cultivated.

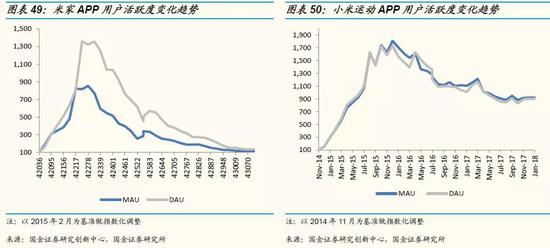

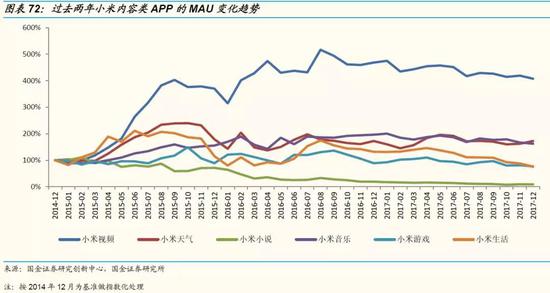

We analyzed Xiaomi’s two most important IOT portal apps: Mijia and Xiaomi Sports. Because there is always a certain deviation in the third-party monitoring data, we use the indexation method to deal with it, mainly focusing on the trend of the use of these two apps. The result is very interesting. With the rapid increase of Xiaomi’s smart products, the number of registered users and active users of supporting apps also increased sharply, but soon, the number of active users began to drop sharply. Millet sports mainly correspond to mi band, and it is sticky to wear every day. MAU has dropped by about 50% since the peak at the end of 2015. Mijia mainly corresponds to all kinds of smart home appliances, and MAU has fallen by more than 80% since its high point in October 2015.The conclusion is: at present, consumers buy smart home appliances mainly out of the mentality of early adopters, and the overall usage habits are far from being cultivated.Therefore, after using it for a period of time, it will return to the basic functions of the product, instead of actively using those intelligent and networked functions on the APP.

Not using the APP function does not mean that Xiaomi smart home products are unpopular.From a large number of media reports, evaluation websites and consumer surveys, it can be seen that consumers are quite recognized for the design, function and cost performance of Xiaomi series products, and the repurchase rate is not low. More than 1.4 million people own more than 5 millet products (excluding mobile phones and laptops). However, at this stage, users still regard Mijia’s desk lamp, kettle and rice cooker as ordinary desk lamps, kettles and rice cookers, but they are not used to using them as networked smart products.

Because the use ecology of smart home is far from being formed, the road to realizing the back-end Internet service of IOT business is still far away. Therefore, different from the market consensus, we believe that to judge the recent development of Xiaomi’s eco-chain business, we have to put aside the concept of "intelligence and IOT" and return to the essence. This essence is product sales, and sales are driven by the breadth and depth of category expansion.

Calculation of potential market space

The information disclosed by Xiaomi on the IOT business line is very limited. In order to better understand the development prospect of this business, we try to calculate the potential market space of Xiaomi IOT products.

Judging from the current product layout, Xiaomi Eco-chain is trying to make its own version of all hardware and consumables closely related to life based on the family scene. However, it is meaningless to simply accumulate the existing market capacity of household appliances, daily necessities, etc. What we are concerned about is that the Xiaomi ecological chain can successfully penetrate, and even how big the market space corresponding to the "pierced" category can be, that is, the so-called effective market space.

By analyzing the changes of various eco-chain products launched by Xiaomi and the eco-chain companies that have disclosed financial information, we can see that the performance of different SKUs will vary greatly. For example, HMI US, which makes smart bracelets, and Kairun Co., Ltd. (300577 CH), which makes 90-cent bags, have maintained rapid revenue growth, and the power future (839032 CH), which makes power strips, has also begun to exert its strength since the second half of 2017. However, from the monitoring data, the sales of air conditioners, drones and daily consumables are very general.

It can be seen that the final sales performance of products is different even if the same strategy is used. So the core problem we are facing is to find out which categories the Xiaomi model is suitable for. For this problem, we analyze it from the following two dimensions:

1) The core of Xiaomi mode lies in the improvement of efficiency in manufacturing and sales. Conversely, any sub-industry with scattered market share at the manufacturing end, more redundant production capacity, complex distribution channel hierarchy and high terminal price increase rate is suitable for Xiaomi to cut in. We believe that small household appliances and some household consumables are very suitable for cutting into the transformation with Xiaomi mode. The manufacturing capacity of TV and notebook computers is concentrated, and the market competition is fierce. Therefore, like mobile phones, they are strategic products that compete for traffic entry and do not rely on hardware to make profits.

2) Many explosions of Xiaomi ecological chain belong to technology consumer products, such as bracelets, balance cars, smart speakers, air purifiers and sweeping robots. These products have created new market segments by integrating scientific and technological innovation, and have obvious first-Mover advantages compared with traditional consumer goods enterprises. At the same time, it can be applied to Xiaomi’s mobile phone supply chain and the shared resources of enterprises belonging to the ecological chain in production, so the cost performance is relatively outstanding. We believe that technology consumer products will be one of the main positions of Xiaomi ecological chain in the long run.

However, the Xiaomi ecological chain is far from growing to the stage where it can completely subvert the existing consumer goods industry. We believe that in many categories where traditional enterprises have built high barriers to competition, it is also very difficult for Xiaomi to successfully enter. These categories can also be divided into two categories:

The first category is that the existing manufacturers have monopolized the core components and supply chain. Typical examples are air conditioners in household appliances and microwave ovens in small household appliances. Excellent enterprises in these categories, such as Gree, Midea and Galanz, have taken a similar path in the fierce market competition: first, build a huge capacity scale advantage, clear their competitors through price war, and then firmly control the supply chain, especially the core components such as compressors and magnetrons, and finally achieve a stable market structure and profit rate.

The second category is that the existing manufacturers have complete product matrix, perfect channel coverage and far ahead market share. A typical example is the patch panel. In March, 2015, Qingmi, a subsidiary of Power Future, launched a millet patch panel with a USB interface and a price of only 49 yuan, which broke the comfort zone of the industry and caused great shock. However, Bull Electric, the industry leader with a market share of over 60%, quickly followed up, benchmarking Xiaomi in design concept and technology, and then resisting Xiaomi’s offensive with a wider product line (more than 300 vs Xiaomi 5) and deeper offline channels (800,000 sales points nationwide). In the future, the revenue growth rate of Power from 2015 to the first half of 2017 will not exceed 25% year-on-year, and it will not enter the track of rapid growth until the product line is fully broadened in the second half of 2017.

According to the main categories of Xiaomi ecological chain by the end of 2017, we estimate that the total market space will reach 2.3 trillion yuan in China. According to the current category of millet with a large shipment and a certain market share, the effective market space is more than 800 billion yuan. We predict that by 2022, the effective market space of Xiaomi ecological chain will reach about 1.3 trillion yuan in China. In the future, as the categories of Xiaomi’s ecological chain gradually enter or break through increase, we will improve the market capacity forecast accordingly.

Lei Jun never hides his love and admiration for Costco and MUJI. We believe that the brand spirit behind these two successful enterprises is exactly what Xiaomi is trying to build on IOT and consumer products: a consumer brand with satisfactory design, reassuring quality and comfortable price, which can be purchased at will without making mistakes. When consumers are faced with choices, they will continue to choose Xiaomi in order to reduce the risk of trial and error, considering the popularity of Xiaomi or the experience of purchasing other millet products. This is the brand strategy adopted by the company to support the rapid horizontal expansion of its categories and grasp the trillion market space at home and abroad.

The important means to support this brand strategy is the systematic design concept. The eco-chain industrial design team under the leadership of Liu De adopted the "family pedigree" design strategy similar to that of the automobile industry, giving the products a unified style and connotation. The design of a single product is mainly black and white and simple, which is not eye-catching, but it is fine in workmanship, exquisite in materials and reliable in performance. When Xiaomi series products are put together, the overall product recognition will be very high, and they can be harmoniously integrated into the decoration style of most families, thus triggering consumers’ willingness to buy a series of products under Xiaomi/Mijia.

Another starting point to support this brand strategy is the application of big data. Compared with traditional consumer goods companies, Xiaomi has accumulated a huge amount of user data (at present, it has exceeded 230PB, equivalent to 57.5 million DVDs, and it takes 575 years to download with 100 MB broadband). This includes not only user portrait data such as gender, age and region, but also user behavior data such as hobbies and online behaviors, as well as health data such as body shape, exercise, sleep and basal metabolism. Xiaomi is actively using its own data resources to grasp consumers’ preferences to design products, and explore online store location, product mix and distribution.

The power of data insight is powerful. Let’s look at a case. Mijia rice cooker is a typical big data thinking product. Its design, accessories and packaging continue the consistent style of Xiaomi products and can meet the tastes of most consumers. Functionally, it focuses on IH pressure cooking; There are only three models, the only difference is the different capacity, and the appearance and function are basically the same.

In addition, Mijia rice cooker deliberately simplifies the control panel, leaving most of the complex functions to APP. On the one hand, it can be networked to form a part of smart home, on the other hand, it is also conducive to collecting more user behavior data. In contrast, there are more than 50 varieties of Midea rice cookers on sale, which are quite different in design style, color, function and price. Although the richness of SKU can meet the preferences of different consumers, we believe that traditional manufacturers such as Midea lack data accumulation, and have insufficient knowledge and grasp of the functions, colors and appearances that consumers need most, and they need to try and make mistakes through different models, which is inefficient.

Consumers in China are the group most affected by the Internet lifestyle, and various industries in China are being promoted by the Internet thinking. Looking at the world, there are many markets that can use Xiaomi products and models to improve efficiency and enhance consumer satisfaction. Therefore, Xiaomi is destined to become an international company.

Similar to the logic of smart phones, we believe that Xiaomi eco-chain products have great potential in many emerging markets. However, due to the great differences in consumption power among countries, the penetration and promotion of Xiaomi eco-chain still need a long time and appropriate strategies.

Taking India, where Xiaomi first entered, as an example, we studied the local home appliance market, and the main conclusions are as follows:

1) The overall purchasing power of the Indian market is still not high, and there is great room for improving the penetration rate of household appliances.Even in the first-tier cities of Mumbai and New Delhi, most of them are low-and middle-income families (about 80% of Indian families earn less than $4,000 a year). According to ICEC data, only 40% of households in India have televisions, 29% have refrigerators, 11% have washing machines, 6% have computers or laptops, and less than 4% have air conditioners.

2) Home appliances are mainly in the middle and low end, and foreign brands occupy the middle and high end.There are high, medium and low-end household appliances in the Indian market, but the low-end products account for more than 70%. Indian local brands BAJAJ, cromā, VOLTAD and Bluestar are leading in the low-end market, while the middle and high-end brands are basically monopolized by Samsung, LG, Panasonic, Hitachi and Whirlpool. China brands such as Midea and Haier are exploring the market.

3) Home appliance sales are mainly offline, and the proportion of online e-commerce is about 6-10%.

According to an interview with Manu Kumar Jain, managing director of Xiaomi India by Forbes magazine, Xiaomi has started to sell air purifiers and bracelets in India, and will launch TV, water purifiers, scooters and rice cookers in the future. We compared the price and performance of Xiaomi eco-chain products through Amazon India and Flipkart, the mainstream e-commerce platforms in India.

On the whole, whether Xiaomi eco-chain products can be successful in emerging markets like India, choosing the category to promote is the key. Xiaomi has obvious cost-effective advantages in some categories (such as smart TV and suitcase); It is superior in the functionality of washing machines, electric kettles, rice cookers and other categories, but it is not superior in price because of the low-end local demand. In addition, due to different national conditions, the demand for air purifiers in the Indian market is weak, while the demand for products such as water purifiers is obviously strong.

In the previous analysis, we have elaborated on the unique business model of ecological chain. Under the strategic framework of "industry+investment", Xiaomi formed an alliance with the best product team at the lowest cost, and gained the first-Mover advantage of China consumer-grade IOT industry in the shortest time. From the financial point of view, the eco-chain successfully superimposed the equity investment income on the basis of traditional product sales, fully amplified the economic benefits of an ecosystem, and once again demonstrated Lei Jun’s profound understanding of the Internet industry-finance integration model.

In 2017, the gross profit margin of IOT and consumer products business line was 8.3%, slightly lower than 8.8% of smartphone business. We judge that this is the reason for the drag of smart TVs and laptops with low gross profit margins. As far as consumer-grade IOT products are concerned, the overall gross profit margin should exceed 10%. Although the contribution of IOT business to the company’s gross profit is only 12.9%, from the perspective of operating profit, we can find that IOT and consumer goods should be the most profitable business line of Xiaomi after the equity investment income is superimposed.

According to the data in the prospectus, the fair value change of Xiaomi’s long-term investment reached 6.35 billion yuan in 2017, accounting for 52.0% of the adjusted operating profit. If this part of revenue is excluded, Xiaomi’s operating profit margin will drop from 10.9% to 5.3%. In 2017, the balance of Xiaomi’s long-term investment was 18.8 billion yuan. Although the company did not disclose the specific details of long-term investment, we judged that most of Xiaomi’s preferred stock investment worth 11.4 billion yuan (typical investment means for start-ups) belonged to eco-chain enterprises and their related industrial chain investments.

First of all, for product projects, Xiaomi will cooperate with different product teams by setting up joint ventures. For example, Shanghai Shuomi and Shanghai Runmi jointly established by Kairun and Tianjin Jinmi, a subsidiary of Xiaomi; Camellia Co., Ltd. (603615 CH), which specializes in plastic household products, recently established Aishang Life with Tianjin Jinmi; Beikos (833908 CH), a new third board company, also established Xiumei Fashion with Shunwei Venture Capital and Tianjin Jinmi. Xiaomi’s investment in a single joint venture generally does not exceed 5 million yuan, and the proportion of equity obtained varies from 10-40%. Since the startups in which Xiaomi shares are easily favored by venture capital and get financing at a relatively high valuation, we believe that this new model will effectively reduce the input cost of Xiaomi’s ecological chain and significantly improve the return on investment in the future.

Secondly, for the technology and supply chain resources needed by the ecological chain, Xiaomi will use direct equity investment more. After the SKU of IOT and consumer products has expanded to a certain scale, we believe that Xiaomi needs to start to build a perfect underlying platform to support the rapidly growing business scale. At one end of this platform are high-quality parts suppliers and OEM enterprises with cost advantages. Xiaomi must use equity investment instead of ordinary business cooperation to lock in these upstream resources. At the other end of the platform are the core technologies needed by IOT services, such as AI, VR/AR, IOT solutions, big data and cloud services. With giants such as Huawei and Midea joining the competition of the Internet of Things, Xiaomi needs to ensure self-sufficiency in core technologies.

3. Internet service: counterattack

Xiaomi’s Internet service mainly includes three parts: 1) advertising revenue mainly based on the realization of mobile APP and smart TV traffic, 2) share income from operating online games, 3) paid content subscription income (music, literature, video), online live broadcast income and Internet finance income. According to the company’s prospectus data, the proportion of Xiaomi’s Internet service revenue to total revenue has never exceeded 10% in the past three years, and even fell by 1 percentage point to 8.6% in 2017. Although Lei Jun has always believed that the Xiaomi model does not rely on hardware to make money, but mainly relies on Internet services to realize it, but the monthly users with nearly 200 million MIUI have only achieved a single-user income of 57.9 yuan, and Xiaomi’s Internet service business has not been eye-catching so far.

Although it was criticized by some users in the initial stage of advertising business, Xiaomi’s attitude towards traffic realization at this stage can be summarized as: restraint. This is the biggest feeling after we have experienced a lot of millet products. Xiaomi’s corporate culture is product-oriented, and Lei Jun himself is an excellent product manager. Because of this, Xiaomi is more cautious in the way of realizing money, and is very concerned about the user experience. It does not affect the reputation of the user group because of short-term profits, which is consistent with the idea of excellent products such as WeChat.

APP distribution revenue is the main source of cash realization for mobile phone manufacturers, which is generally realized through pre-installation and application stores, and is priced through CPA(Cost Per Action). When you activate a new Xiaomi mobile phone, you can see that the number of pre-installed apps is only about 20. Except for Xiaomi apps, all of them are top applications, such as Today’s Headline, JD.COM, Iqiyi, Weibo, etc. There are no games or apps below the waist for promotion.

Xiaomi APP Store is the app with the largest number of users in Xiaomi and the fourth largest Android application distribution platform in China. At present, the domestic MAU exceeds 100 million, which has nearly tripled in the past two years. Compared with the IOS system, the Android application market in China is scattered, mainly divided into Xiaomi Store, Huawei App Store and OPPO App Store in the mobile phone department, and Baidu Mobile Assistant, 360 Mobile Assistant, Tencent App Store and pea pods in the Internet department. Because the application market is an important entrance and source of income, each market will block the download of other application markets for competition. Therefore, users mainly come from their own advantageous channels, namely, pre-installation of mobile phones and diversion of their own apps. Xiaomi APP Store has maintained a consistent "cleanliness" style in the UI, and it is quite restrained in app recommendation and advertising space. It has not added a large number of information streams or video advertisements like most application markets, and the frequency of information push is limited.

Xiaomi’s Internet advertising is not much different from its competitors in business structure. It mainly distributes brand advertisements and effect advertisements through its own mobile phone APP, smart TV and Xiaomi Box. The display forms include regular screen opening, banner, Jiugongge, search bar, information flow and video pre-posting. In addition, Xiaomi also provides a traffic platform for APP developers in the form of Xiaomi Mobile advertising alliance, and developers can embed the advertising SDK to get the revenue share of Xiaomi advertisers.

It is worth noting that Xiaomi attaches great importance to the internal diversion and realization of its own traffic. Compared with external advertisers, we think Xiaomi is more willing to cross-drain in his own application ecology and improve the realization value of single users by means of "software+hardware". For example, Xiaomi App Store will use the best advertising space to guide eco-chain products and Xiaomi Finance. Xiaomi calendar guides the self-owned content products such as video and reading; Xiaomi Mall conducts water for Mijia and Youpin, etc.

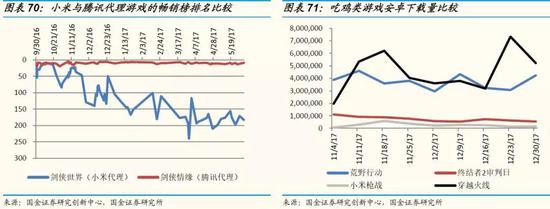

Objective factors: there are still shortcomings.